33 Passive Real Estate Investing Terms You Need to Know

This article is part of our guide on passive investing in multifamily via syndication, available here.

Key Takeaways

-

It will make it easier to interpret and analyze real estate market reports and to truly understand key concepts and real estate investing strategies.

-

The more you immerse yourself in this real estate investing dictionary to brush up on your vocabulary, the better foundation you’ll have.

Multifamily Real Estate Terms:

Before getting involved in any real estate deal or investment in commercial real estate like apartment buildings, for example, you should familiarize yourself with the fundamental commercial real estate investment terms. Look at this guide as your commercial real estate terminology sheet, as it will bring light and context to the key terms every passive real estate investor should know.

Below are all the terms you need to know.

Capitalization Rate (CAP)

The capitalization rate is the return rate based on the property’s expected income. The cap rate is calculated by dividing the net operating income by the market value of a property (NOI/current market value= cap rate). For example, a property with an NOI of $525,000 acquired for $7,500,000 has an in-place cap rate of 7%.

Net Operating Income (NOI)

The net operating income (NOI) is calculated by taking the property’s total income and subtracting it from the operating expenses, not including capital expenditures and debt service (gross income-operating expenses= NOI). For example, a property with $1,250,000 in total income and $500,000 in operating expenses has an NOI of $750,000. An example of adding NOI could be by charging a move-in fee or a flat fee for water.

Preferred Return

A preferred return is simply a preferential order of priority of payout for a particular class of investors based on the expected rate of return hurdle set in place.

For example, let’s say you invest $100,000 into a real estate syndication and the preferred return for the deal is 6%. That would mean that the first $6,000 of free cash flow available for distribution from the deal would preferentially go to you before the real estate syndicator/sponsor receives any share of the distributions.

Capital Expenditures (CAPEX)

Capital expenditures are the funds used to make upgrades or repairs to the property. For example, we acquire an income-producing property, upgrade all the appliances, and add granite countertops and hardwood flooring. The aforementioned would be a part of your CAPEX budget.

Internal Rate of Return (IRR)

The internal rate of return (IRR) is the rate needed to convert the sum of all future uneven cash flow (cash flow, sales proceeds, and principal paydown) to equal the equity investment. IRR is one of the main factors the passive investor should focus on when qualifying a deal.

A straightforward example is, let’s say that you invest $50. The investment has a cash flow of $5 in year one and $20 in year 2. The investment is liquidated at the end of year 2, and the $50 is returned. The total profit is $25 ($5 year 1 + $20 year 2). Simple division would say that the return is 50% ($25/50). But since the time value of money (two years in this example) impacts return, the IRR is only 23.43%.

If we had received the $25 cash flow and $50 investment returned all in year 1, then yes, the IRR would be 50%. But because we had to “spread” the cash flow over two years, the return percentage is negatively impacted. The timing of when cash flow is received significantly and directly impacts the calculated return. In other words, the sooner you receive the cash, the higher the IRR will be.

Cash On Cash Return (COC)

The cash-on-cash return is the rate of return on an annual basis of the total capital contribution that an investor has contributed to a deal. For example, if an investor invests $100,000 into our syndication and receives distributions that total $10,000 on the year, their COC return would be 10% ($100,000/$10,000= COC).

General Partner (GP)

The general partner (GP) is an owner of a partnership who has unlimited liability. The GP is responsible for managing the entire asset. A general partner is also usually a managing partner and an active day-to-day operator. The GP is also referred to as the sponsor or syndicator in a syndication.

Limited Partner (LP)

The limited partner (LP) is a partner whose liability is limited to the extent of the partner’s share of ownership. In a syndication, the LP is the passive investor and funds a portion of the equity investment.

Apartment/Real Estate Syndication

It’s a practical technique for investors to combine their money to acquire larger real estate assets that they wouldn’t be able to manage or afford as individuals. This means not being the landlord and having to deal with all the headaches of hundreds of tenants and vendors. Generally, appreciation is forced through physical and operational improvements, and the asset is managed in-house.

There are numerous parties in real estate syndication, including property managers, lenders, attorneys, the real estate broker, CPAs, and the syndicator who puts the entire thing together and manages the asset (Willowdale Equity) and you, the passive investor.

Pro-Forma

The Pro-forma is a financial projection to forecast an apartment complex’s financial production. This projection would likely highlight line by line all the income and expense assumptions for a certain period.

Rent Roll (RR)

The rent roll is a line-by-line report that details information such as the rental income and status of every unit in an apartment complex.

What's the difference between a split and a waterfall?

The split is the investment returns that are provided to the investors in the portion of the split. So, if the split is 70% to the investors and 30% to the deal syndicator (Willowdale Equity) after the preferred return is paid (if there is one), then the partners split all other proceeds from distributions or capital events 70/30. That split can change if a specific hurdle (or waterfall) is achieved.

For example, a split could be 70/30, then go to 50/50 once the IRR hits 18%. Any returns higher than 18% will then be split 50/50 (Investors/Syndicator), which is a ‘waterfall.’

What is a K-1?

A Schedule K-1 form is an acknowledgment of the tax income for the year. Each investor involved in a deal will receive one. This is a typical practice with real estate partnerships and LLCs. In addition, if you can qualify as a real estate professional, you could take passive losses from your schedule K-1 and apply them against your active income.

1031 Exchange

This strategy in the United States tax code allows you to defer paying capital gains taxes on the sale of a commercial property. When you invest through a self-directed IRA, this process shares a similarity in that depending on how you structure your IRA; you may be able to shelter a large amount of your real estate income.

Vacancy Rate

This expresses the percentage rate of unoccupied units in an apartment complex. For example, if I have a 100-unit apartment with only 50 units occupied, I have a 50% vacancy rate.

Occupancy Rate

This expresses the percentage rate of occupied units in an apartment complex. For example, if I have a 100-unit apartment with only 95 units occupied, I have a 95% occupancy rate.

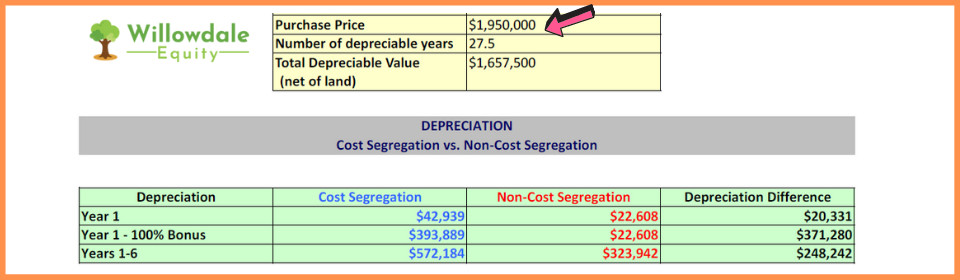

Depreciation

Depreciation in commercial real estate is the value of an item’s decline over time (on paper) while the actual value continues to climb. The depreciation loss that you can deduct in a multifamily property is sometimes more (or nearly as much) than the cash flow generated by the property. Meaning the taxable amount may be $0 or extremely close to it.

Loan-To-Value (LTV)

Lenders determine how much debt will be on a property or is already on a property through an LTV ratio. Let’s say, for example, that the purchase price is $5,000,000 or the property is valued at $5,000,000, and I go out and get a mortgage loan for $3,750,000; this would be reflected as a 75% LTV. Generally, LTVs range from 65%-75% but can go as high as 85% LTV depending on the type of real estate project.

Exit Strategy

This is how the apartment building will have some liquidity event. Generally, this refers to the sale/disposition of an apartment building, but it can also refer to a large refinance or sale of a portion of the equity.

Appraisal

This independent 3rd party survey is completed on behalf of the lender. This report showcases an assumption of value based on various data points, such as comparable sales figures and market assumptions. The lender uses this report as a base for the value of a property to determine sufficient LTV ratios and the property’s risk profile.

Commercial Real Estate (CRE)

The income-producing rental properties that fall under the CRE umbrella are large multifamily/apartment buildings, industrial, retail, office, and special-use properties like gas stations.

Cash Flow

Your cash flow is the net income that the property produces. To find this number, you would subtract your total operating expenses and total debt service from your total gross income; what’s leftover is your cash flow.

Private Placement Memorandum (PPM)

This is a document that LP investors will review before investing in a real estate syndication offering. This document highlights all the terms of the investment and the associated risks.

Accredited Investor

An accredited investor meets the SEC requirements for income and net worth, as the Securities and Exchange Commission (SEC) set forth. This is so that the SEC provides adequate protection to all investors. You must meet at least one of the following criteria to be an accredited investor:

The term “accredited investor” refers to an individual who satisfies the standards and criteria established by the Securities and Exchange Commission (SEC) regarding financial assets. The SEC does this to protect investors adequately. If you can satisfy at least one of the following conditions, you may be classified as an accredited investor:

1️⃣ Have an annual income of $200,000, or $300,000 for joint income, for each of the last two years, with expectations of earning the same or higher income this year.

2️⃣ Have a net worth exceeding $1 million, not counting your primary home.

Sophisticated Investor

A sophisticated investor is someone who has enough understanding and experience business-wise to be fully aware of the upside and downside of an investment. Still, this individual does not meet the financial standards to be classified as an Accredited Investor.

Debt Service

This is the total payment you make each month for the mortgage on the rental property; this is often referred to as your loan payment.

Debt Service Coverage Ratio (DSCR)

This is a metric lenders use to evaluate if the property is healthy and can afford to easily make mortgage payments based on the rental property’s cash flow. (NOI / Total debt service= DSCR). Typically lenders like to see at least a 1.25 DSCR to qualify.

Breakeven Occupancy

The breakeven occupancy is the bottom line occupancy number that the property needs to maintain to break even. You can calculate this by taking your annual operating expense + your annual mortgage payment / your annual gross income ($200,000 + $154,000 / $480,000 = 73% Occupancy)

Operating Expenses

These are all the expenses required to operate the property every month. These items include repairs, the water bill, property taxes, and other items.

Note: Your operating expenses do not include your debt service.

Physical Occupancy

This is the number of physically occupied units (50 occupied units / 60 units = 83% Physical Occupancy).

Economic Occupancy

This is the number of units actually paying rent (45 paying units / 60 units = 75% Economic Occupancy).

Investment Property

A real estate property purchased with the assumption to generate a return on the capital contributed.

Fair Market Value (FMV)

This is the sales price that a property would sell for in an open market.

Property Tax

Property taxes are a tax paid by an individual or an entity that owns the subject rental property. The local government of where the investment property is located sets the calculation for how much is owed, and the property owners pays it.

Frequently Asked Questions About Real Estate Investing Terminology

Commercial Real estate is truly one of the best investment vehicles for passive income for various reasons. To name a few, an asset class like multifamily can produce strong cash flows, therefore, providing real estate investors with a solid risk-adjusted return in a hedge against inflation. Multifamily real estate is not a speculative investment; it has stood the hard test of time and continues to excel as U.S. housing continues to have supply issues nationwide. It provides a very predictable and study return as people need somewhere to live.

To truly consider a real estate investment a passive one, an investor must not have any active role in the real estate partnership. Passive commercial real estate investments might involve an individual investor investing in a real estate syndication, which would be considered a Limited Partner (LP). This structure would be an example of a 100% passive investment where the passive investor or LP would collect a check every month or quarter, depending on the deal.

When someone in commercial real estate investing refers to a PG, they are talking about a Personal Guarantee. The lender/bank sometimes requires personal guarantees from the sponsor of a deal (like us here at Willowdale Equity). This is essentially a personal pledge or guarantee from the sponsor/syndicator to take on a specified amount of liability for the deal at hand, may it not go according to plan.

Not all real estate investing is passive; in fact, most real estate investing requires heavy operation and an extensive knowledge base to execute the business plan for an investment property effectively. But investing in a multifamily real estate syndication would be an example of where a highly operational asset class like multifamily that maybe has 100’s of tenants to manage would allow a busy professional to leverage the deals sponsor/syndicator experience, time, and know-how to invest without all the operational headaches.

Real Estate Investing Terms - Conclusion

The more you immerse yourself in this real estate investing dictionary to brush up on your vocabulary, the better foundation you’ll have. Before learning core investment strategy and becoming a property owner, you should grasp these core terms of investment and learn more about the various types of multifamily investment strategies.

It will make it easier to interpret and analyze real estate market reports and truly understand critical concepts and investing strategies.

Interested In Learning More About PASSIVE Real Estate Investing In Multifamily Properties?

Get Access to the FREE 5 Day PASSIVE Real Estate Investing Crash Course.

In this video crash course, you’ll learn everything you need to know from A to Z

about passive investing in multifamily real estate.

We’ll cover topics like earned income vs passive income, the tax advantages, why multifamily, inflation, how syndications work, and much much more!