CLO vs CMBS: What is the Difference Between CMBS and CLO?

This article is part of our guide on fannie mae and non-recourse loans in multifamily, available here.

CLOs and CMBSs are the choices if a traditional loan is unavailable or does not fit the needs to purchase or finance a property. CLOs and CMBSs allow a purchaser or a team of purchasers to buy a property. What is critical is the structuring of these options and how they differ from a traditional FNMA or FHLMC loan.

Both types of loans obligate the borrower or borrowers to ensure payment in a timely fashion. Still, a newcomer’s exposure to risk is much lower than a traditional Fannie Mae or Freddie Mac loan. These obligations have risen in popularity, especially since the COVID-19 pandemic began. With the pandemic, the secondary market took a hit, and many mortgage companies either had a reduction in staff or closed down completely.

This article discusses the differences and some of the advantages and disadvantages of these financing options.

Key Takeaways

-

A CLO is a collateralized loan obligation. Collateralized loan obligations are single securities backed by a pool of debt. These are then pooled into a marketable security.

-

CMBS is an acronym for commercial mortgage-backed security, and it is a debt asset much like a mutual fund or an exchange-traded fund.

-

They both have different features, functions, and benefits and since they serve different needs of the investors, you need to consult with a professional advisor for advice given your particular needs.

What is CMBS Debt?

CMBS is an acronym for commercial mortgage-backed security, and it is a debt asset much like a mutual fund or an exchange-traded fund. In 2007, when the financial crisis hit, the extant regulations for this type of lending were not what it is today. It is composed of a pool of debt that has been grouped into a single bond. Bondholders receive periodic payments.

When these debt assets have been sufficiently pooled, they are treated as one loan for the purposes of investment and interest payments. The implications of having these CMBSs are clear for the multifamily investor because these loans can be used to purchase apartments or other multifamily homes. Another option for an investor is a CLO.

What is a CLO in Real Estate?

A CLO is a collateralized loan obligation. Collateralized loan obligations are single securities backed by a pool of debt. These are then pooled into a marketable security.

These obligations are backed by corporate loans, often with low credit ratings or loans that private equity firms take out so they can conduct leveraged buyouts. When the investor receives payments, the investor takes on most of the risk in the event of a default. In exchange, the investor has more diversity and greater potential for higher returns. There are differences between a CLO and a CMBS.

There are different risks that a portfolio manager will look at, such as their risk profile, operational risk, credit risk, and market risk.

Portfolio managers look at how a position in a CLO investment will affect the bottom line. This is called operational risk or risk profile. Credit risk is how much exposure to loss a portfolio manager can tolerate.

If the counterparties’ credit is subpar, there will be more risk, and if there is an economic downturn, the chances of default rise. Finally, inherent market risk is dictated by the swings in the LIBOR (London interbank offered rate) Index. Management capability is an indicator of the skills of the portfolio manager’s ability to adjust to pre-payments on these loans.

Good Read: Libor to SOFR Transition Timeline

What is the Difference Between CMBS and CLO?

There are many differences between a CMBS and a CLO. They, by design, are in place to serve different types of transactions. A CMBS has restrictive structures, risk retention requirements, and more conservative lending practices. CMBS securitizations come from multiple lenders with terms of five or ten years, and these loans are fixed for those terms.

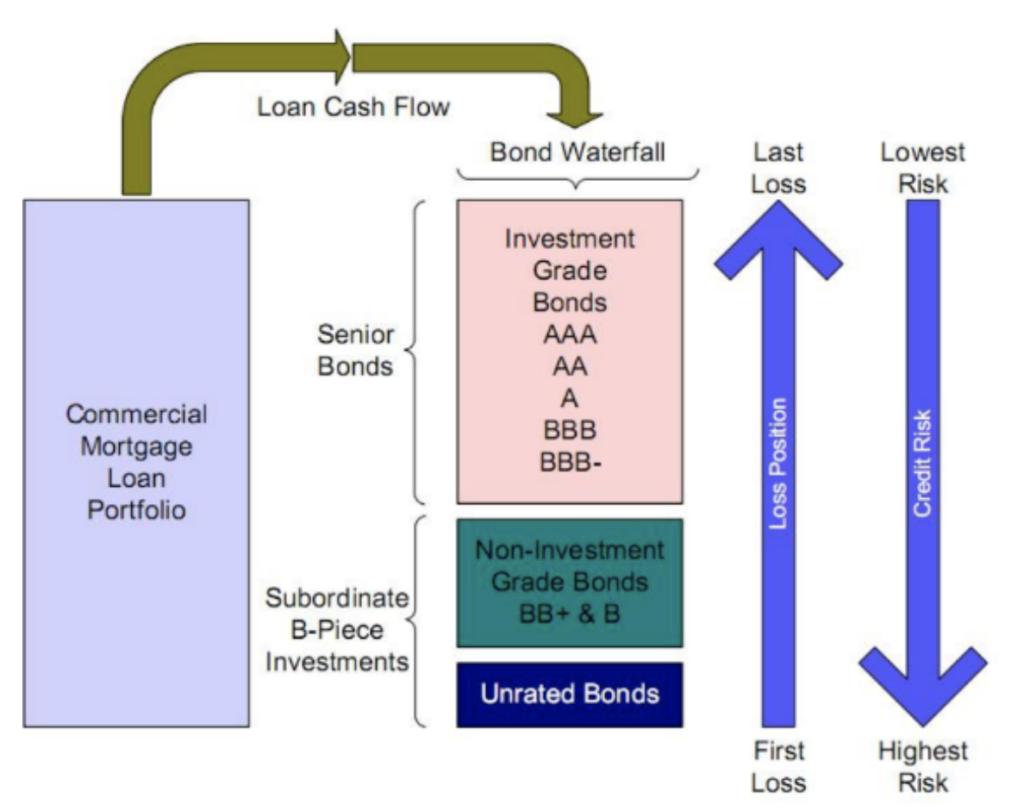

The properties for this loan type are fully stabilized and the properties are from different CREs. When the loans are packaged and securitized, the first loss position, AKA the B-piece, is purchased by a third party. The third party has control rights over the pool, and if there are problem assets, they can select a special servicer in addition to the mix of loans.

Unlike conforming loans, where the mortgage lender is paid via the interest, these investors are paid once the bonds are sold since the bonds are comprised of a pool of loans.

Conforming loan requirements apply to a conforming loan. That is when Fannie and Freddie’s guidelines are applicable regarding maximum loan limits, a minimum credit score, and down payment resulting in the loan to values. Because a CLO can be comprised of loans with lower credit scores, some of the debt acquired could be non-conforming loans, depending on how many of these loans are held in an investor’s pipeline.

Adjustabilites of CMBS and CLOs

CLOs are typically adjustable and have the ability to use transitional assets and properties. These properties can be from lease-up on new construction to a fully stabilized property. Frequently, an office needing management or an apartment complex with units that need to be updated or refreshed will benefit by financing via a CLO instead of a CMBS. The lender will need to see business plans, which must be customized, so the lender has tight controls on borrower activities and cash flows. The manager can add or subtract loans during a reinvestment period.

CMBSs typically cannot be structured this way. With a CLO, the risks to capital are mitigated; ultimately, the bonds on these loans can be sold at a lower interest rate. CLOs also utilize a balance sheet. The manager is more familiar with the properties since, unlike a CMBS, which is a one-time transaction, his involvement is closer to the borrowers, and his approach can be more hands-on with the underlying loan pool.

Frequently Asked Questions About Commercial Mortgage Backed Securities in Commercial Real Estate

Bond investors make money via the interest when they acquire loans in a bundle. These bundles are a combination of different loans from different lenders. The bundles are securitized and the interest is paid on the bonds.

CMBS loan means commercial mortgage-backed securities. They are also called conduit loans. They are typically one of the funding types for apartment buildings, multifamily units, commercial office buildings, and other similar properties.

CLO vs CMBS - Conclusion

CLO and CMBS loans are the products of choice for investors, especially if they are interested in acquiring properties and acquiring the debt-assets from them. They both have different features, functions, and benefits and since they serve different needs of the investors, you need to consult with a professional advisor for advice given your particular needs.

The federal government has regulations in place to prevent what happened during the financial crisis in 2007.

If you’re interested in building long-term wealth through private equity illiquid tax-advantaged multifamily real estate across the southeastern United States, join the investor club today.

Sources:

- SmartAsset, “Commercial mortgage-Backed Securities (CMBS)?”

- National Association of Insurance Commissioners, “Commercial Real Estate Collateralized Loan Obligations Primer“

The Willowdale Equity Investment Club is a private group of investors that are looking to passively grow their capital and share in all the tax benefits through multifamily real estate investments.