Is Real Estate a Hedge Against Inflation: How Private Real Estate Investments Provide a Hedge

This article is part of our guide on buying real estate during a recession, available here.

Inflation has been a big topic among economists since 2020 as we have seen the cost of materials, consumer goods, and rents, to name a few, skyrocket after the release of trillions in government stimulus to provide economic relief from the pandemic shutdowns. In an inflationary world, people are left asking themselves “is real estate a hedge against inflation?” they want to know how to hedge against inflation and where is the best place to park their hard-earned dollars as a hedge against the erosion in your hard-earned dollars.

The answer is private real estate investments with asset classes like multifamily apartment communities, giving you all the tax benefits that private and direct ownership gets you. Multifamily real estate is one of the most important asset classes for capital preservation. A safe investment that provides day-one returns on investors’ capital contributions. Stabilized cash-flowing properties at market value or value-add arrangements allow us to earn a greater rate of return than the dollar is devaluing. The time value of money is crucial, and cash-flowing assets provide that. Historically, in inflationary environments like today, real estate property values and rents have increased and acted as an inflation hedge.

In this guide, we’ll dive into what exactly inflation is, the four reasons real estate is the best hedge against inflation, how debt in real estate plays in our favor during inflation, and much more.

Key Takeaways

-

What you could buy with $1,000 in 1980 would now cost around $3,260 based on an average inflation rate of 2.94% yearly.

-

Inflation in the United States is measured by something called the Consumer Price Index (CPI). The CPI measures the cost of what’s referred to as the basket of goods methodology, which measures rising prices or consumer pricing on things such as food, beverages, cereal, milk, coffee, medical care costs, toys, and much more.

-

Suppose you’ve invested in a strong market. In that case, rents should naturally increase on average 2%-3% per year, which is a strong hedge against natural inflation of 2%-3% per year, keeping pace with inflation without a decline in demand.

-

Real estate is unique because it has two components of intrinsic value which both have limited supply and provide a basic human need; they are as follows.

-

Hard assets like multifamily real estate achieve this through their intrinsic value, appreciating value, increase in income/rents, and depreciating debt.

What is inflation?

Inflation is the increase in the prices of goods and services in a given economy over a certain period. It means that prices generally go up each year, which means that the purchasing power or value of a dollar becomes worth less and less. Naturally, inflation is expected to increase at 2%-3% year over year.

For example, what you could buy with $1,000 in 1980 would now cost around $3,260 based on an average inflation rate of 2.94% yearly. What’s alarming is that the cost of living continues to increase while wages are not growing at the same rate. Inflation in the 1980s reached as high as 13.5%, so it’s not unreasonable to believe that inflation will continue to have larger-than-average increases every so often.

How is inflation measured?

Inflation in the United States is measured by something called the Consumer Price Index (CPI). The CPI measures the cost of what’s referred to as the basket of goods methodology, which measures rising prices or consumer pricing on things such as food, beverages, cereal, milk, coffee, medical care costs, toys, and much more.

But there are many flaws and inaccuracies with the CPI as a measure of inflation, as some essential items are left out of the basket of goods that skew the numbers. Despite all the scrutiny surrounding this index, the CPI is one of the most critical government statistics, as it influences many important public programs.

One of the main criticisms from the economic analysis is that the projected annual 2%-3% inflation average that the government clocks each year is not an accurate representation of the true inflation numbers. What supports this criticism is that the government is incentivized to keep these statistics as low as possible. The higher the inflation rate, the more dollars they will have to spend on critical social programs. Programs such as federal civil service retirees, social security beneficiaries, and food stamps, to name a few, are some programs that the government would have to spend more on each year to keep pace with inflation.

The Coronavirus Pandemic and the Inflation Rate

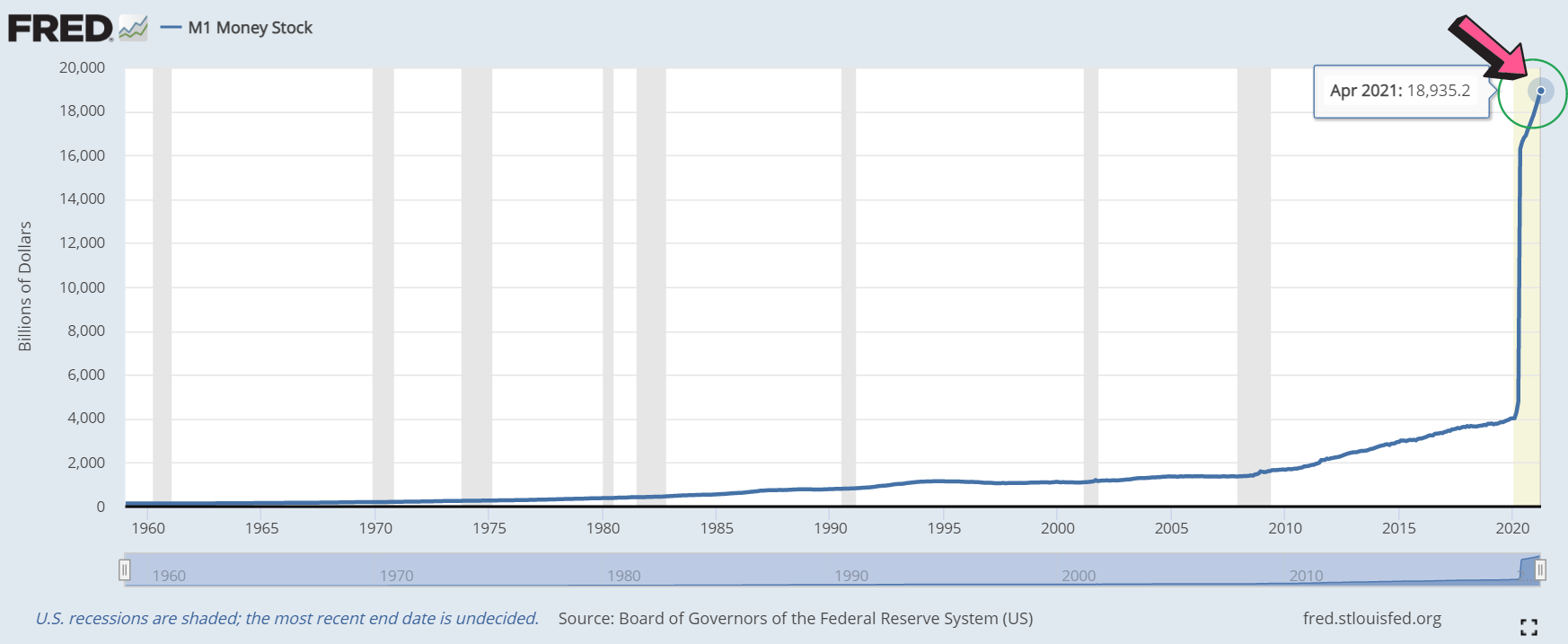

Above is the The M-1 Money Supply from 1959 to 2021

The Federal Reserve has employed quantitative easing through the implementation and approval of several rounds of stimulus packages to help alleviate the effects of the COVID-19 pandemic. 30% of the money supply was printed in 2020. Starting with a $2.2 trillion economic stimulus bill that was passed by congress on March 27th, 2020 when the first Cornavirus Aid, Relief and Economic Security (CARES) Act was passed.

As you can see in the chart above, at the beginning of 2020, the U.S. senate significantly increased the money supply by injecting these trillions of dollars into the economy to expand and reinvigorate economic activity. As a result, it has devalued and eroded the dollar.

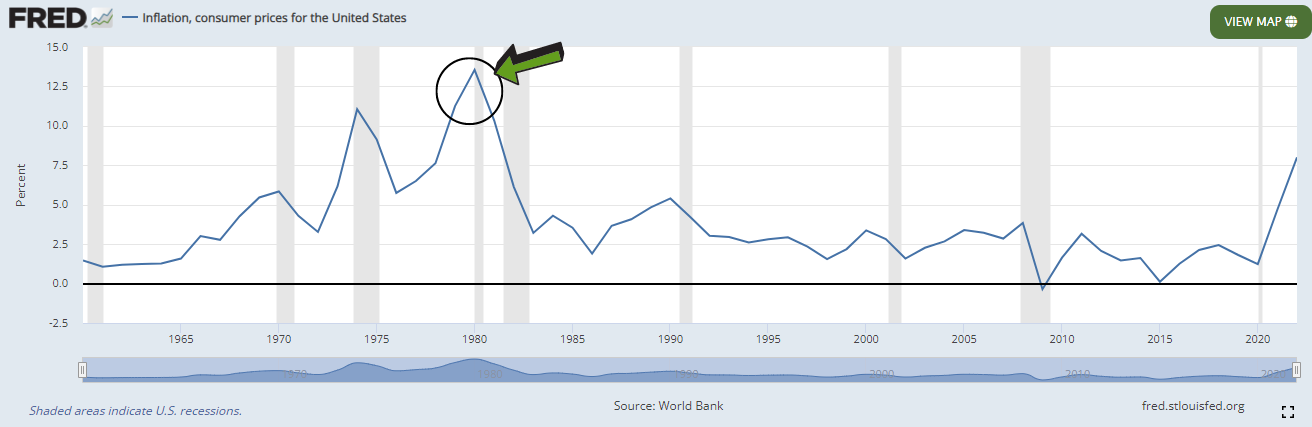

Above is the Consumer Price Index (CPI) from 2011 to 2021

Is Real Estate a Hedge Against Inflation?

Suppose you’ve invested in a strong market. In that case, rents should naturally increase on average 2%-3% per year, which is a strong hedge against natural inflation of 2%-3% per year, keeping pace with inflation without a decline in demand. In 2021, the U.S. was currently facing a lumber shortage which saw lumber prices rise as much as 400% and further added to the housing shortage. Simply having your hard-earned dollars sit in the bank slowly erodes your purchasing power and, therefore, the opposite of inflation protection.

For Example: If inflation is 5% and your money is sitting in the bank and able to get even 1%, that would mean that your buying capacity would be eroded by 4% year over year.

There are four core reasons why real estate is a hedge against inflation, and they are as follows:

- Intrinsic Value

- Appreciating value

- Increase in income/rents

- Depreciating debt

1.) Intrinsic Value

Unlike soft assets such as stocks and bonds, real estate is a hard asset, and hard assets hold intrinsic value due to their naturally scarce limited supply.

For example, oil and natural gas can be used to barter or produce goods, but the value of paper money can be devalued to zero if there’s an oversupply and no use for it.

Real estate is unique because it has two components of intrinsic value which both have limited supply and provide a basic human need; they are as follows.

- The Land

- The Building

In terms of land, there’s a limited amount of it, which makes it so valuable. In terms of building, there is currently a supply shortage across the United States for affordable housing, which is really driving property prices. A part of what’s driving that supply constraint is the cost to build new units. Factors like inflation are driving up costs and making it harder for developers to build an affordable product that makes sense for them on a return basis.

As a result, it increases the value of existing buildings as the replacement cost to build that exact product type would be way more expensive today and have a higher risk profile.

2.) Appreciating value

Appreciation of asset values is one of the most significant ways real estate investors build long-term wealth. When you buy the right properties and manage them right, you’ll always win if you’re there for the long term. Asset prices continue to climb as cap rates continue to compress nationwide, cap rate spreads widen further, and natural rent growth is directly tied to asset values.

$500,000 of Net Operating Income (NOI) / 0.09 Capitalization Rate (CAP) = $5,555,555 Value

$500,000 of Net Operating Income (NOI) / 0.08 Capitalization Rate (CAP) = $6,250,000 Value

3.) Increase in income/rents

If you’ve invested in a healthy market, rental prices and rental income will generally rise by 2% to 3% each year, effectively offsetting natural inflation of 2% to 3%. Also, as inflation increases housing costs and the cost to operate an apartment building, landlords will continue to push that cost onto tenants in an effort to offset it.

4.) Depreciating Debt

Inflation erodes the value of a dollar over time, which is owed to a natural depreciation of the dollar year after year. It’s important to remember that today’s money is worth more than tomorrow’s money.

Borrowers that use debt to finance their real estate projects are essentially paying their lender back the money that they took on. Still, each year that passes, the original principle of the loan is worth less than when they initially took on the debt. Multifamily is one of the strongest commercial real estate asset classes and has kept up with natural inflation. Generally, a property owner can increase rent yearly by the same amount as natural inflation.

While hard asset prices continue to rise, asset values increase, widening the gap between what investors borrowed to buy the assets years ago.

Has real estate been a good hedge against inflation and will it be in the future?

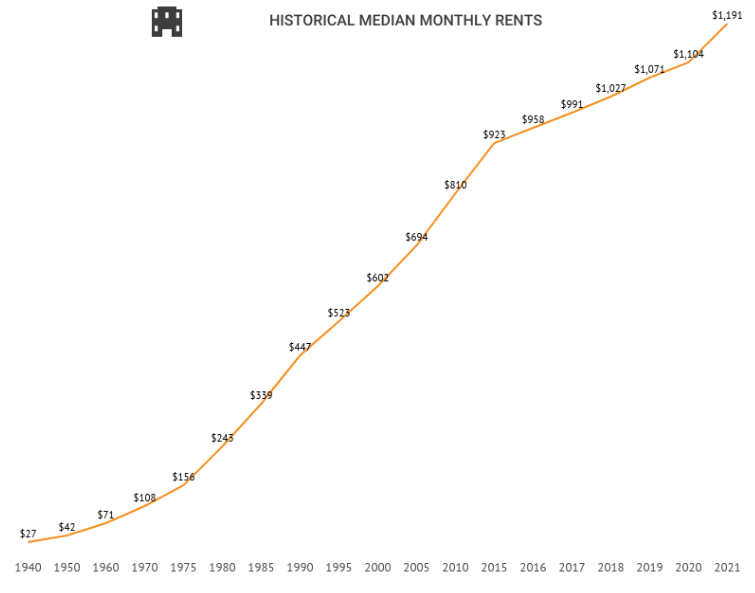

Real estate has historically performed a strong hedge against inflation regardless of interest rates. In the charts below, you’ll see how rising rent prices continued to increase at an accelerated pace even during major inflation environments throughout the 1970s and 1980s.

Above is the Consumer Price Index (CPI) from 1950 to 2022. As you can see, inflation hit a high of 13.5% in 1980.

Above is a chart that tracked the national rent average from 1970 to 2021. As you can see in 1980 when inflation hit all-time highs, rents surged.

Above is a chart that tracked the national average rental increase year over year. In 1980, rental prices increases by 11.98% on the year. Throughout the 70s and 80s, rental prices climbed at the same pace of inflation.

S&P 500 & The Stock Market

Most businesses that benefit the most from inflation usually use little capital. In reality, stock prices in the S&P 500 comprise several technology businesses and communications services. The main drawback is that the index gives higher weights to companies that have the most markets.

The index has little value for smaller players with higher returns over time. Similar investments exist, but they may suffer disadvantages when investing in an index. SPY, the SPDR S-P 500, is an index for the 500 biggest US publicly traded corporations. The SPY Net asset portfolio is $252 billion with an expense ratio of 0.0945%.

Frequently Asked Questions About If Real Estate is a Hedge Against Inflation

In hyperinflation, investing in multifamily real estate with high occupancy rates would be wise. The higher occupancy rates will keep the property’s value from plummeting and generate a steady stream of income in a non-cash form that is still easily convertible to cash when you need or want it.

Investing in multifamily real estate is the preferred way to hedge against inflation. With rising prices, renters feel squeezed with rising rents, but landlords can still charge more for their properties because they have secured long-term contract rates with reliable tenants. Investing in multifamily properties with stable leases is the best option for those looking to build wealth on a steady return basis.

Yes. Capitalizing on properties that increase in value when inflation is high can provide you much more value than an investment bank would offer.

Rental property values are fixed, but the price your tenants will pay for rent varies with inflation rates. Higher rental rates mean higher income, while expenses may be lower because many would much rather buy in tough times if they can sell in thriving markets when their properties have increased in value. Owning real estate has one of the highest risk/return ratios of any investment. During periods of extreme inflation, landlords may outperform banks by a large margin each year, giving them greater purchasing power and stable returns even when other investments cannot keep up.

Is Real Estate a Hedge Against Inflation - Conclusion

Private real estate investments provide a solid risk-adjusted return, incorporating all the components of a robust inflationary-resistant investment vehicle that features all the excellent tax benefits of direct ownership. Hard assets like multifamily real estate achieve this through their intrinsic value, appreciating value, increase in income/rents, and depreciating debt. It’s important to keep inflation in the equation when evaluating your next investment opportunity. Solid core, core plus, value-add, and opportunistic private real estate investing have proven to be a reliable investment vehicle. It’s exemplified this through its ability to appreciate historically.

With these types of investments, an investor is not only protected from inflation but also protected from market crashes. Additionally, private real estate investment leads to passive income streams. Investors can get cash flow while managing their wealth in other areas. This is just one of many ways to protect your investments against inflation.

And remember, due to factors like inflation, a dollar today is worth more than a dollar tomorrow!

Sources:

- Investopedia, “Stimulus Package“

- Investopedia, “Limitations of the Consumer Price Index (CPI)“

- Forbes “If You Want To Know The Real Rate Of Inflation, Don’t Bother With The CPI“

- BLS.GOV “Consumer Price Index data quality: how accurate is the U.S. CPI?“

- FRED.StLouisFED.ORG “Inflation, consumer prices for the United States“

- IPropertyManagement “Average Rent by Year“

- HOME.Treasury.GOV “About the CARES Act and the Consolidated Appropriations Act“

- MySmartMove “How to Price Rent in a High Inflation Environment“

Interested In Learning More About PASSIVE Real Estate Investing In Multifamily Properties?

Get Access to the FREE 5 Day PASSIVE Real Estate Investing Crash Course.

In this video crash course, you’ll learn everything you need to know from A to Z

about passive investing in multifamily real estate.

We’ll cover topics like earned income vs passive income, the tax advantages, why multifamily, inflation, how syndications work, and much much more!