Real Estate Syndication Structure: (EXPLAINED)

This article is part of our passive investors guide on real estate syndications, available here.

Today’s investors are faced with many challenges related to supply chain issues, a high inflationary market that’s eroding their purchasing power, and the seeking of risk-adjusted assets that produce a strong yield. Real estate syndications are amongst the best way for investors to hedge all of the above in a completely passive role.

But before investing in a syndication, it’s essential to understand the different types of real estate syndication structures and what that means for you, the real estate investor.

In this article, we’ll showcase the real estate syndication structure, how to structure a real estate syndication, some example scenarios, and which structure is best for you.

Key Takeaways

-

The real estate syndication structure is how cash flow distributions and profits are shared between general and limited partners.

-

Some structures are much cleaner, and others are more complex, with varying changes in profit slits based on performance hurdles being met.

-

A Straight Split and a Waterfall are two core ways to structure a real estate syndication.

The Two Parties in a Real Estate Syndication

In a real estate syndication, there are two main parties involved, and they are as follows:

- General Partners: The general partners are the individuals or real estate syndication company that bring the deal together and open the investment up to limited partners. The general partner might also be referred the operator, the syndicator, or the real estate sponsor. The GPs are in a fully active role in this partnership, which means not only locating the deal, due diligencing it, securing the financing, and raising the capital, but also operating the deal daily.

- Limited Partners: The limited partners are the individuals who invest capital in the deal. Their only responsibility is to bring capital to the deal, as they are completely passive in the partnership.

Let’s now look at what the correct entity structure might look like in a syndication.

The Entity Structure in a Real Estate Syndication

The two most common legal entity structures used to form a real estate syndication are the following entity structures:

- Limited Partnership (LP)

- Limited Liability Company (LLC)

It’s important to note that a real estate syndication can be structured in many ways. The general partner/sponsor creates this structure to lower the exposure to liability, which passive investors/limited partners do not have any exposure to.

That could mean that passive investors/limited partners can invest directly into the LLC that owns the property or into a separate LLC or LP that owns an interest in the LLC that directly owns the property. These flow-through entity structures can get confusing, but the complexity of these flow-through entities add more protection and create more distance from liability.

Let’s now look at what the organizational chart might look like in a syndication.

Real Estate Organizational Chart Example

As I mentioned in the previous section, the entity structure to form a real estate syndication can greatly vary.

The organizational chart above, it shows the structure where an LLC owns the property, and there are two tranches of shares referred to as Class A and Class B shares. The limited partners/passive investors would own Class A shares, while the general partner/sponsor would own Class B shares.

Real Estate Syndication Structure

The real estate syndication structure is how cash flow distributions and profits are shared between general and limited partners. Some structures are much cleaner, and others are more complex, with varying changes in real estate syndication fees and profit slits based on performance hurdles being met.

There are two core ways to structure a real estate syndication, and they are as follows:

- Straight Split

- Waterfall

Straight Split Structure

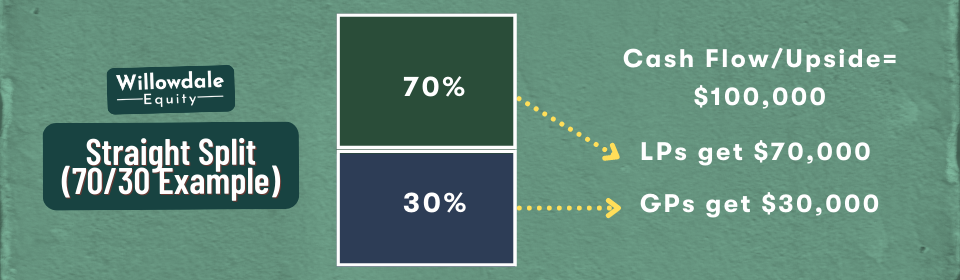

The straight split structure is the most straightforward way of structuring how profits are shared in a deal. It means that the general and limited partners split the cash flow distributions, refinance, or sale proceeds based on the predetermined ownership percentage.

Let’s now look at an example of a straight split syndication structure.

Straight Split Example

Let’s say the ownership split is a 70/30, 70% of the ownership is the limited partners, and 30% is the general partners. In the scenario, if $100,000 of cash flow were to be distributed to the partnership, 70% ($70,000) would go to the limited partners/passive investors, and 30% ($30,000) would go to the general partners/syndicator.

Waterfall Structure

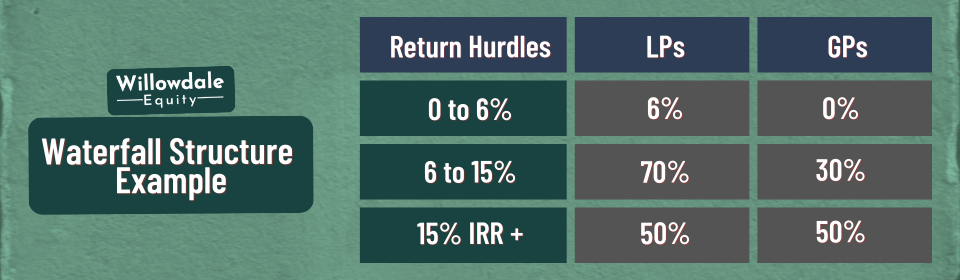

The waterfall structure is a typical way of structuring a real estate syndication. The waterfall refers to how profits flow to investors based on when predetermined return hurdles are met.

Let’s now look at an example of a waterfall syndication structure.

Waterfall Structure Example

Let’s say the first return hurdle deal is to pay the limited partners/passive investors a 6% preferred return, which means the first 6% return on the passive investors’ capital would be paid out before the real estate syndicators get their share. Over and above that 6% payout to investors, the excess cash can be distributed 70/30, 70% to the passive investors, and 30% to the syndicator.

Then there could be a second return hurdle where once the deal achieves a 15% IRR (internal rate of return), the profit split could change to a 50/50, 50% going to the passive investors and 50% going to the syndicator.

Now let’s examine which structure is better for you and which has your best interest at heart.

Good Read: What’s a PPM in Real Estate & What is Included in a PPM?

Which Real Estate Syndication Structure is Better for Investors?

Determining which real estate syndication structure is best for you comes down to an array of variables, the number one being your real estate investing goals. There is no one size fits all for investors, so it’s essential to evaluate the following items to understand which structure might be best for you:

- Investing Goals: Knowing what exposure to an investment you want relative to how much capital you have available to invest changes how you would prefer deals to be structured.

- Market Cycle: What phases we are in the market cycle and various other economic factors change what you look for in the structure. Meaning cash flow becomes more important than long-term appreciation, which might mean you would prefer a preferred return with a waterfall structure over a straight split.

- Investing With a Self-Directed IRA: If you’re using your self-directed IRA to fund your capital investment in a real estate syndication, you may put less weight on cash flow as you may not be able to touch the funds until the investment matures. Meaning a straight split might be a bit more lucrative as the passive investor keeps more from the split as opposed to different profit splits as different return hurdles are met.

- Investment Strategy/Business Plan: If you’re investing in a deep value-add or more opportunistic type of real estate syndication deal, then theirs more opportunity to create substantial value, which might have you elect to have a straight split structure.

- Cashflow vs. Appreciation: If you care less about cash flow, a waterfall might be more ideal, and if you care more about appreciation, a straight split might be more ideal.

Frequently Asked Questions About Multifamily Syndication Structure

Most syndicates are structured with a 70 (LP) /30 (GP) split on the upside on the project and likely with a preferred return somewhere in the range of 6% to 8%.

Real estate syndications pay out through distributions, refinances/recapitalization, and a sale event. When these liquidity events occur and how frequent distributions are made to investors is dynamic to the specific syndication and operator of the syndication.

Real Estate Syndication Structure - Conclusion

Examining the deal structure is crucial to ensure alignment with the real estate sponsor and your personal investment goals. The straight split and waterfall structure have their own benefits, and no one structure ensures the highest profit. The preferred return has become a standard part of most syndication structures as it provides the priority of payments to investors while maintaining a strong enough incentive for a real estate sponsor to have the deal perform so they can get paid.

If you’re looking to access private multifamily syndication investment opportunities across the southeastern United States, apply to join the investors club here at Willowdale Equity today.

The Willowdale Equity Investment Club is a private group of investors that are looking to passively grow their capital and share in all the tax benefits through multifamily real estate investments.