The 4 Phases of the Real Estate Cycle Explained

This article is part of our guide on buying real estate during a recession, available here.

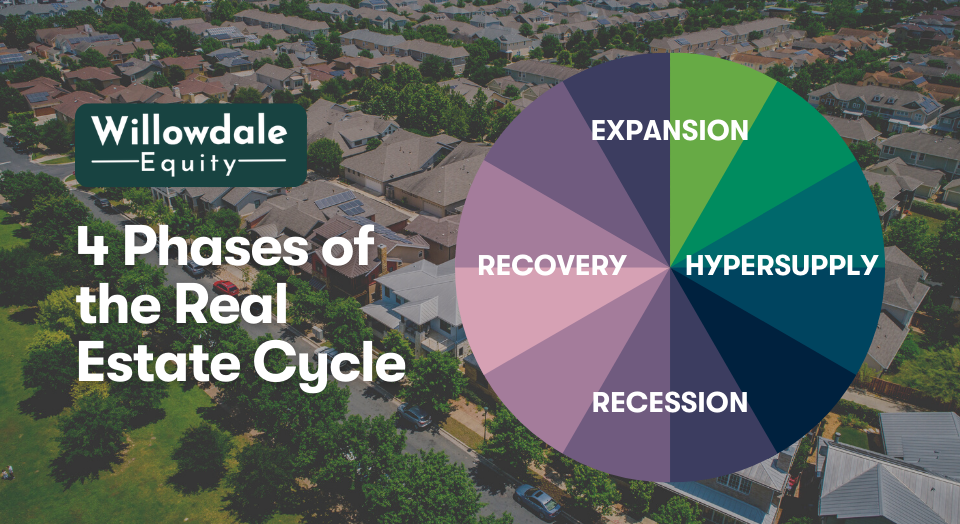

Real estate markets are cyclical, and a real estate investor must know and understand where the market is and where the market is headed. Real estate market cycles follow a four-stage pattern: recovery, expansion, hyper-supply, and recession. These real estate cycles are pretty complex; it’s crucial to remember that they’re happening simultaneously. Even though the national economy is robust, real estate sales in some locations may slow down.

There are currently 25-30 developing markets in the United States at any one moment. It’s fascinating to note that each major city in the United States has its own cycle, which is unique. Meaning Washington, DC, might be in expansion while Boston, MA, could be in recession. Once real estate investors understand these concepts, it gives them more insight into trying to better time entering and exiting a new market.

The good news is that regardless of what real estate phase you’re in, there’s still the opportunity to succeed, especially if you’re willing to stay the long haul on your next real estate investment. In this guide, we’ll break down all the details of what makes up each real estate cycle phase.

Key Takeaways

-

Many researchers believe that real estate cycles last anywhere from 10-18 years.

-

The four phases include Recovery, Expansion, Hyper Supply and Recession.

-

Jobs lead to an increase in real estate prices and demand for residential rental units. However, another factor affects things like this and its population growth.

-

You’ll do well if you’re conservatively underwriting and performing thorough due diligence on the front end, even in the wrong real estate cycle.

How long do real estate cycles last?

Many researchers believe that real estate cycles last anywhere from 10-18 years. Some think it’s a seven-year real estate cycle. But it’s tough to predict; some can last much longer than others. Certain factors can make these cycles much shorter, while others can make them longer. It’s interesting to note that the current cycle that we are currently in is the most extended cycle in the past 60 years.

As you can probably gather from the above, real estate cycles have a significant impact on employment and wages. When people cannot afford to buy where they work, that hurts their morale as well as sometimes forces them to move further away from their jobs so that they can find adequate housing at an affordable rate. This is less than desirable for businesses because it means higher costs for things like gas and bus fares. It also harms the economy because fewer people will be able to save money or invest in stocks or bonds.

When people are spending extra money on transport, this also means less money will be available for restaurants or other local businesses. The economy is a complicated system, but it all boils down to the simple fact that out of sight really is out of mind.

Related Read: The 18-Year Housing Cycle Explained

What is the impact of economic growth on real estate?

In general, jobs are created when there is a lot of economic growth. This creates a need for people to live and work somewhere. This usually leads to an increase in real estate prices and demand for residential rental units. However, another factor affects things like this and its population growth.

It’s interesting how the two are connected. When economic growth occurs, the cost of living increases because businesses need to charge more for their products to boost profit margins.

The idea here is that if you want an increase in housing demand, you must also have a population with greater purchasing power—otherwise, rents will fall, or fewer new homes will be built.

Real estate market cycle chart

What are the four phases of the real estate cycle?

Below are the four phases a real estate market could be in at any given time.

1️⃣ Recovery

- Excess supply of properties on the market

- Prices are falling; rents are falling

- Demand is falling

- Time on the market sharply increases

- New construction is overpriced and stagnant

- Unemployment reaches its height

- People in the construction field struggle to work

- Bank foreclosures sharply increase

- Investment property values decline to the lowest level of all four cycles

We also refer to the recovery phase as “Buyer Phase 1”. This is a great time to buy as prices are very attractive, and things are starting to go up. The recovery stage is the longest stage of the cycle.

2️⃣ Expansion

- Market absorbing oversupply

- Time on market decreases

- Job growth increases

- Existing properties are being rehabbed

- Investment properties are at their lowest levels but begin to increase slowly.

- Rental rates are at their lowest level and have begun to increase slowly

- Competition for Bank foreclosures is fierce as their number declines

We also refer to the expansion phase as “Buyer Phase 2”. This phase is generally the best phase to buy in as you’ll get the shortest duration of time until prices start to heat up as we head into the next phase. Supply is slowing but still high, and the unemployment rate drops sharply from its height during the recovery phase. It’s tough trying to time the market and buy at the absolute bottom as you would sometime in the recession phase; this approach possesses a large amount of risk.

When these cycles occur in real-time, it’s hard to understand when you are at the very bottom of pricing or close to it. This means that these cycles could last a decade from when you buy, all while pricing continues to run down.

Purchasing real estate in the expansion phases does not give the full margin of appreciation like buying at the very bottom would. Still, it does provide a solid risk-adjusted return. By purchasing during the expansion phase, you get all the key indicators that the market is starting to heat up while pricing is still attractive.

3️⃣ Hyper Supply

- The supply of properties on the market dwindles.

- Properties are selling fast, and time on market is at its lowest point

- After a long period of inactivity, speculation and development are in full swing

- Unemployment is low

- Property prices and rents are rising

- Demand for real estate is at its highest point

We also refer to the hyper-supply phase as “Seller Phase 1”. This is the real estate cycle phase where investors are getting top dollar for their properties and would be the worst cycle to purchase in.

In this phase, it’s best to sit on the sidelines and wait for things to cool off. Instead, it’s best to focus on what markets and properties you want to pounce on once the opportunities better present themselves in the subsequent few cycles.

4️⃣ Recession

- Time on the market begins to increase

- The number of properties on the market increases

- Sellers are waiting longer but are still getting inflated prices

- Land is being purchased for speculation

- The amount of construction in the pipeline is excessive, and the potential for overbuilding is likely.

- Demand for construction and materials is rising.

- Prices for construction and material rises accordingly

- Business and Job growth begin to slow

- Rent growth is strangled

We also refer to the recession phase as “Seller Phase 2”. This is ground zero for the economy real estate prices and poses the most significant opportunity to scope up distressed real estate for pennies on the dollar.

What step of the real estate cycle generally follows recession?

The short answer is that the four-phase real estate cycle starts again, which means that we would then enter into the Recovery phase.

Frequently Asked Questions About What stage of the real estate cycle are we in

According to studies, real estate life cycle stages last anywhere from 10 to 18 years. However, predicting their duration is difficult; some can go on for far longer than others.

The buy phase in a real estate market cycle is also referred to as the recovery phase as “Buyer Phase 1”. This is a wonderful buying moment because values are incredibly low, and things are improving.

Like the real estate market cycle, the economic or business cycle also moves in 4 stages. They are (1) peak, (2) recession, (3) trough, and (4) expansion. The length of each stage varies highly. Seasonal changes and long-term trends complicate the calculation of the business cycle since consumers are unprepared for the change in the cycle.

What stage of the real estate cycle are we in? - Conclusion

Long-term success in commercial or residential real estate investing, especially in the multifamily game, requires a good understanding of the four-phase real estate cycle. If you play the long game in real estate, based on history, you’ll always win. Buying cash-flowing assets like multifamily properties is crucial to your overall real estate investing strategy, whether actively or passively investing.

You’ll do well if you’re conservatively underwriting and performing thorough due diligence on the front end, even in the wrong real estate cycle. Keep your finger on the pulse and know your local investing market, but remember, the best time to invest in real estate was yesterday!

If you want to learn more about passively investing in recession-resilient real estate, check out our how it works page.

Interested In Learning More About PASSIVE Real Estate Investing In Multifamily Properties?

Get Access to the FREE 5 Day PASSIVE Real Estate Investing Crash Course.

In this video crash course, you’ll learn everything you need to know from A to Z

about passive investing in multifamily real estate.

We’ll cover topics like earned income vs passive income, the tax advantages, why multifamily, inflation, how syndications work, and much much more!