Real Estate Waterfall Equity Structure (Catch-Ups, Clawbacks & Hurdle Rates EXPLAINED)

This article is part of our passive investors guide on real estate syndications, available here.

The real estate waterfall structure in real estate investing is a sophisticated way to model and fairly distribute cash flow and equity based on pre-set hurdles or when certain return hurdles are achieved. These sometimes complex structures are put in place when several or many investors are involved in a real estate project to keep incentives and interests aligned concerning ownership and returns.

In this article, we’ll explain how the financial waterfall model, preferred returns, and cashflow waterfall models work in real estate investing and why they benefit the sponsor of a real estate project and its investors equitably.

Key Takeaways

-

The financial waterfall in a private real estate investment considers that real estate investors sitting at different places in the capital stack with varying levels of risk and reward are fairly allocated cash distributions in the proper preferential sequence.

-

A preferred return is a preferential order of how cash flows are distributed to investors based on a set hurdle or set rate of return before other types of investors, including any general partners, receive their share of the cash flow distributions. It is also referred to as “the pref.”

-

The advantages of a distribution waterfall equity structure in a private commercial real estate investment are that real estate investors at different stages in the capital stack are fairly compensated in the correct order.

-

When several investors are involved in a real estate project, it is essential to set up structures to keep incentives and interests aligned

What is a Financial waterfall and how does it work with cash flow

The financial waterfall in a private real estate investment, considers that real estate investors sitting at different places in the capital stack with varying levels of risk and reward are fairly allocated cash distributions in the proper preferential sequence. This waterfall of payments will have been predetermined in the real estate partnership prior to entering into an agreement and closing on the said property.

Hurdle Rate in Private Equity

Real estate waterfall equity structures could also utilize a carveout that allows the general partner/sponsor of the deal to achieve a higher share of the gross profit on the sale of the property if the investors earn a certain minimum return.

This is often referred to as a hurdle, and the hurdle could be set on any return metric; for example, the hurdle rate could be set to achieve a 15% Internal Rate of Return (IRR) or a certain desired Equity Multiple of invested capital. Once the hurdle mentioned above is met, for example, the remaining cash flow or gross sale proceeds are split in a predetermined way.

Preferred return waterfall

A preferred return is a preferential order of how cash flows are distributed to investors based on a set hurdle or set rate of return before other types of investors, including any general partners, receive their share of the cash flow distributions. It is also referred to as “the pref.”

For example, if let’s say the preferred return for a private equity fund for a multifamily investment is a 8% preferred return with a 70 (General Partners)/ 30 (Limited Partners/Passive Investors), that would look like as follows:

Suppose your initial equity investment was $100,000, and your preferred return was 8%. That means the first $8,000 of free cash flow would be distributed to you, the passive investor, before paying any other general partners. Then any cash flows left after the $8,000 would be cash flow splits of 70/30, with 70% of the excess cash flow going to the passive investors and 30% of the excess cash flow going to the general partners/sponsor.

Here at Willowdale Equity, we offer a preferred return on all of our deals, ensuring that our passive investor partners are prioritzed to recieve cashflow before us.

Preferred Return Calculator

Enter the initial equity investment, preferred return rate, and cash flow:

How do Real Estate Sponsors Determine the Appropriate Hurdle Rates or Preferred Returns?

Determining hurdle rates or preferred returns in real estate syndication is a blend of art and science. Sponsors consider market conditions, project risks, and investor expectations to set rates that balance attractiveness with feasibility. Factors like project location, asset class, and investment duration all influence these decisions.

But there is generally an industry/market standard that is set, and most sponsors try to structure deals competitively to what the market offers at that particular point in time.

The benefits of a waterfall equity structure

The advantages of a distribution waterfall equity structure in a private commercial real estate investment are that real estate investors at different stages in the capital stack are fairly compensated in the correct order. For example, investors must account for risk and reward before committing capital toward a real estate syndication.

This is mainly because where your capital sits in the capital stack dictates what risk your capital is at in the event of default, and your reward for that particular level of risk should be at parity. That’s what distribution waterfalls lend to investors, a way to allocate capital distributions in a manner that takes into out risk and reward fairly.

Examples of how waterfall equity can be used in real estate transactions

Waterfall equity structures can be used in many ways; some of the more common methods are preferred return waterfalls which would break down earlier in this article; another way is through IRR equity waterfalls or equity multiple waterfalls.

Below are examples of some typical real estate distribution waterfall structures:

IRR Hurdle Waterfall Example:

Let’s say the IRR hurdle is 15% which would mean that once the investors achieve their 15% IRR on capital invested in the deal in the form of cumulative cash distributions, refinance proceeds, and sale proceeds from the real estate project, anything after is split 50/50.

That would be an example of where investors achieve a solid target of 15% IRR, and the project’s real estate sponsor/operator receives a bonus for hitting those return hurdles.

Equity Multiple Waterfall Example:

Let’s say the Equity Multiple hurdles are set to 2x, which would mean that once the investors achieve a double-up of their initial investment in the deal in the form of cash distributions and some refi and sale proceeds from the real estate project, anything after is split 60/40.

That would be an example of where investors double their capital, and the project’s real estate sponsor/operator receives a bonus for hitting those return hurdles.

Two-Tiered Waterfall Example:

The two-tiered waterfall model is what it sounds like, which is a different waterfall structure for two other aspects of the deal. For example, let’s say that for any operating cash flow distribution, it’s an 8% preferred return to investors.

Then any total cash flow is a 70/30 like our IRR hurdle example above, but for any capital event like a refinance or a sale of the property, those proceeds are split 60 (GP)/40 (LP).

Complex Waterfall Example:

A more common waterfall that more investors are starting to become more accustomed to seeing in new real estate investment offerings is Class A, Class B, and Class C investment tiers.

Before we dive into an example of what that would look like, it’s important to note that this type of structure is great for providing the real estate sponsor with an excellent incentive to execute the project. But also allows investors to diversify where they invest in the capital stack to spread out their risk and potential returns.

Here’s an example of this investor class tier waterfall structure:

- Class A Investors: These investors receive an 11% preferred return, is 1st priority for cash flow distributions and do not participate in any upside of the deal. They must invest a minimum of $100,000.

- Class B Investors: These investors receive an 8% preferred return, is 2nd priority for cash flow distributions, and participate in 70% of the project’s upside. They must invest a minimum of $50,000. Once they achieve a 2x Equity Multiple, excess capital is split 50/50.

- Class C Investors: These investors receive a 9% preferred return, are 3rd priority for cash flow distributions and participate in 70% of the project’s upside. They must invest a minimum of $500,000. Once they achieve a 2x Equity Multiple, excess capital is split 50/50.

We used this exact Class B and C, two-tiered structure on a value-add 335-unit garden-style multifamily property that we acquired in San Antonio, TX.

The Clawback Provision in Private Equity

The private placement memorandum (“PPM”), a legal document that provides all the details and risks associated with the proposed investment, would likely feature clawback provisions. The clawback provision protects investors and states that they can be repaid back if the General Partner or Sponsor group mistakenly pays itself a fee they were not entitled to.

This may happen as an accounting error or negligently; regardless of the reason, this provision ensures investors can be made whole in this event.

To reduce the chance of this occuring, measures such as thorough financial audits and oversight mechanisms help mitigate the risk of accounting errors or negligence.

What is the Difference Between the Clawback Provision and the Look Back Provision?

While both provisions are mechanisms used in financial arrangements, they serve different purposes and operate in distinct ways.

As we went over in the last section, a clawback provision is designed to protect investors by allowing them to recover excessive profits that may have been paid out to general partners or sponsors due to accounting errors or negligence.

On the other hand, a look back provision allows for a retrospective adjustment of distributions based on actual performance compared to predetermined benchmarks or targets.

Instead of focusing on reclaiming excess profits, the look back provision adjusts distributions to ensure that investors receive their agreed-upon returns over the entire investment period, even if initial performance falls short of expectations.

In summary, while both provisions involve retrospective adjustments, the clawback provision is about reclaiming excessive profits, whereas the look back provision is about ensuring investors receive their expected returns despite fluctuations in performance.

Catch-Up Provision in Private Equity

The catch-up clause is a provision to ensure that the General Partner or Sponsor group is fairly compensated based on the total investment return of a project instead of solely relying on the return in excess of the set hurdle rate or preferred return for investors.

This means the Limited Partner receives 100% of the profits or cash flow until their predetermined preferred return hurdle is met.

Then the General Partner receives 100% of the profits or cash flow over and above the Limited Partner’s preferred return hurdle until they are caught up with their performance fee. Then all the remaining excess profits or cash flow above the preferred return and GP catch-up will be on whatever the predetermined split is.

For this example, let’s use the following inputs:

6% Preferred Return

70%/30% Split (LP/GP) – Limited Partners receive 70% of the profits and upside in the deal; General Partner receive a promote structure of 30% of the profits and upside in the deal.

The chart below showcases cash flow distributions for the complete hold of the project.

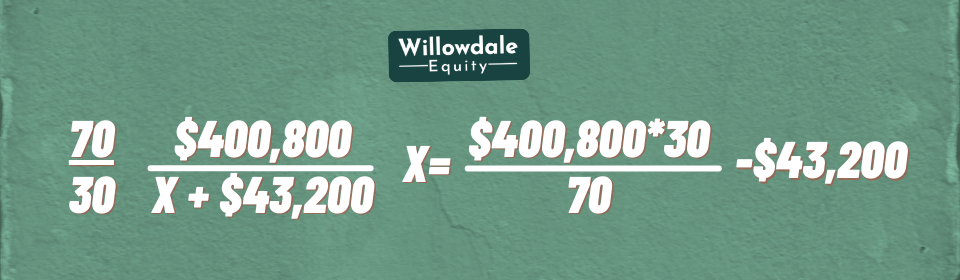

When you look at the total column for the LP row of the chart above, you can see that the LPs have received 90.2% of the cash flow distributions ($400,800/$444,000=0.902), and the GP has only received 9.8% ($43,200/$444,000=0.0972).

The GP needs to catch up to 30% of the profits from the cash flow before they can share in the profits from the sale that are also split 70/30. Therefore, we would perform the following formula to have the GP “catch up” to their predetermined 30% share of all the profits.

X = $128,571.42

The GP would now have received a total of $171,771 after receiving their private equity catch-up of $128,571, and the LP would have received their $400,800; this completes the 70/30 split. Any profits from the sale over and above this catch-up provision will be split 70/30.

Frequently Asked Questions About Real Estate Waterfall Model

Waterfall in private equity refers to the model or structure of how cash flow distributions or capital events in a partnership are allocated concerning the general and limited partners (passive investors) in a deal.

Waterfall equity models work by allocating which shareholders get what and when regarding cash distributions and capital events in a real estate partnership. These private equity waterfalls can be as complicated or simple as you make them.

The preferred return is a simple return expectation that the general partner or sponsor of a real estate project sets out in the operating agreement. There is no fancy calculation to find the preferred return number for investors, but typically it’s somewhere between a 6%-8% preferred return.

The difference is that the hurdle rate is a pre-determined way of how profits will be split once a specific target return metric is achieved, and the IRR or internal rate of return is a particular metric of return that converts the sum of all future uneven cash flows.

Waterfall Model Real Estate Conclusion

When several investors are involved in a real estate project, it is essential to set up structures to keep incentives and interests aligned. A waterfall structure does this by dividing cash flow/equity according to pre-set hurdles or when certain return hurdles are achieved. Such sophisticated models can be a fairer distribution for all participants to keep everyone incentivized and interested.

The complexity of these waterfall structures may be daunting at first glance. Still, it can often lead to more efficient outcomes than other models like the partnership approach, where each partner typically has an equal share of profits even if they don’t contribute equally.

If you’re interested in learning more about private multifamily real estate investing or interested in investing in one of our next exclusive multifamily investment opportunities, click here to join our private investment club.

Sources:

- Investopedia, “Distribution Waterfall“

- CREModels, “What is a Private Equity Waterfall?“

The Willowdale Equity Investment Club is a private group of investors that are looking to passively grow their capital and share in all the tax benefits through multifamily real estate investments.