The 10 Year Treasury: What it is and how it relates to Multifamily CAP rates and values

This article is part of our guide on what a good cap rate is for multifamily, available here.

Before we get into what the 10-Year Treasury is, it’s important to note that commercial real estate values for multifamily properties are closely correlated to it. So understanding its function and where the trends are headed will give us an indication of where values will be around the corner.

Key Takeaways

-

The 10-year Treasury yield is very significant because it’s a critical indicator that many industries use to identify where things are heading economically, especially things like mortgage rates which help stimulate the economy.

-

When investors lose confidence in where things are at or headed, investors will elect to move their cash to safe government bonds. As a result, yields will drop due to considerable demand for this safe investment vehicle.

-

The higher the expectation of growth rate in NOI will show up in the spreads between CAP rates and 10-year Treasury yields. The larger the spread, the stronger the outlook.

What is a 10-Year Treasury Note

It’s simply a 10-year debt obligation issued by the U.S. government with a maturity of 10 years upon its issue date. So you’re basically lending money to the U.S. government, and they’re paying you fixed interest rates on the money every six months. The U.S. government also issues these loans with 2, 3, 5, and 7-year maturity dates and pays a higher yield on the longest-term note, which is the ten-year.

Lending to the U.S. government is a safe investment vehicle as they are unlucky to default on a note. As a trade-off for its security, investors receive a lower yield/rate of return.

Why the 10-Year U.S. Treasury Yield Matters

The 10-year Treasury yield is very significant because it’s a critical indicator that many industries use to identify where things are heading economically, especially things like mortgage rates which help stimulate the economy. But the yield the U.S. government is offering on a 10-year note gives an outlook of investor sentiment for the economy.

When confidence in the market is high, the yield offered on these notes will rise as investors don’t feel the need to move their cash to a safe vehicle that provides a low yield. This is because they feel they can safely get a much higher return in public markets and that it’s worth the risk. When investors lose confidence in where things are at or headed, investors will elect to move their cash to safe government bonds. As a result, yields will drop due to considerable demand for this safe investment vehicle.

Multifamily CAP rates and values

Multifamily housing, which is interchangeably referred to as rentals or apartments, has historically outperformed other commercial real estate asset classes such as Student Housing, Office, Retail, and Hotels.

There are many different ways to analyze multifamily properties. By analyzing multifamily properties, you can make better decisions about your multifamily investment with the future in mind. Multifamily real estate has many advantages, especially when compared to single-family investing.

Value in multifamily real estate is derived from what yield an investor is willing to receive on their purchase by making assumptions on current and future Net Operating Income (NOI). Historical multifamily cap rates tell us that even though there is currently high cap rate compression, interest rates will change that eventually. Will that happen next year, in three years, or in five years? That’s the million-dollar question. But we know that just because rates have risen substantially and fast, inflation has still charged ahead, increasing apartment incomes and future valuations.

Net Operating Income (NOI)

The NOI is your Gross Income – Operating Expenses. Through operational efficiencies and optimization, you can reduce your expenses to boost your NOI, add value, and charge more to collect more gross income. The higher your NOI, the higher the value is, as commercial real estate investors are willing to pay more.

For example, You collect $100,000 in rent every month and have $40,000 in expenses to operate the property, which leaves you with $60,000 of NOI ($100,000 – $40,000=$60,000 NOI). Annually that would put you at a $720,000 NOI ($60,000 NOI X 12 Months= $720,000 NOI)

NOTE: Your NOI does not include your mortgage payment, as whoever would potentially buy the property from you would likely put new debt on it, which puts your current mortgage payment outside of that NOI calculation.

Capitalization rate (CAP Rate)

The capitalization rate is the return rate based on the property’s expected income. The cap rate is calculated by dividing the net operating income by the market value of a property (NOI / Current Market Value= CAP rate). For example, a property with an NOI of $720,000 that was acquired for $10,285,714 has an in-place cap rate of 7%.

CAP rates and multifamily valuations are inversely related, which means that the higher the CAP rate, the lower the valuation is; inversely, the lower CAP rates are, the higher valuations are.

For example, let’s say an apartment has a $720,000 NOI and a market CAP rate of 7%, meaning that the apartment is valued at $10,285,714 ($720,000 / 0.07= Market Value).

Let’s say another apartment also has a $720,000 NOI, but this time has a market CAP rate of 5%, meaning that the apartment is valued at $14,400,000 ($720,000 / 0.05= Market Value).

In these two scenarios, having a lower 2% CAP rate on the same amount of NOI resulted in a net gain of $4,114,286 in valuation.

What is a good cap rate for apartment buildings?

A reasonable cap rate, or the average cap rate for apartments, is between 4-7%.

The capitalization rate (cap rate) will assess how much money an investor needs to spend to purchase the property, fix it up, and generate enough income to pay their loan back with interest while still earning a “positive return” on their real estate investment.

Investors commonly determine the right price for an apartment building by using the capitalization rate system to calculate its value. The calculation of this metric will involve determining the cost of owning the apartment buildings over time versus what kind of cash flow you will get from rents to make it worth considering investing in them.

Why is the 10-year Treasury falling?

The 10-Year Treasury is falling because of a decrease in demand, or it could also be that people want to purchase bonds, but the ones with lower interest rates are getting snatched up first.

What happens when you have less demand? The price goes down. When less money is spent on something, suppliers have to drop their prices, or they will run out of money.

Will the 10-year treasury go up?

The answer to this question entirely depends on the market’s outlook on future economic growth.

The 10-year treasury will not continue rising in perpetuity, but having a very sound economy and a stable government that has been able to form successful policies and promote growth for the near future. It also depends heavily on how optimistic people are about an economy doing well. In other words, yes.

Why is the ten year yield important?

The ten-year yield is significant because it is a crucial indicator of interest rates in the United States.

The 10-year yield tells us whether investors expect inflation to rise or fall based on whether they want to take more risks to make their money grow faster. If you think there will be higher inflation, then you’ll pull your money out of investments with lower yields and invest them in ones with higher ones. If you think there’s going to be less inflation, then you’re willing to settle for slower growth so long as your money is safe by investing in low-risk but steady investment options with lower yields.

10-Year Treasury and CAP rates in Commercial Real Estate

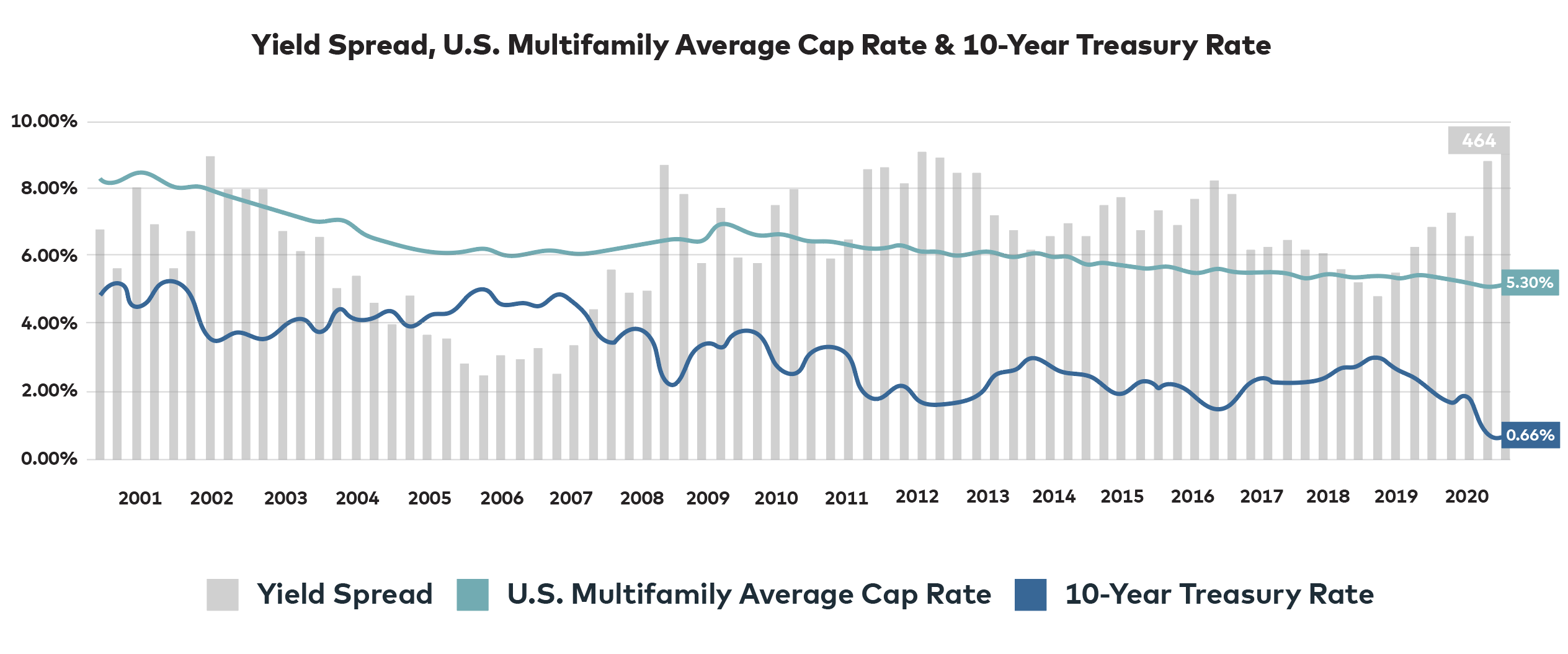

The larger the spread, the stronger the outlook. As you can see above in late 2020-early 2021, there is a large spread in yields when looking back over the last decades.

Now that you understand more about how value is calculated and how when CAP rates compress, each dollar of NOI is worth more, we can now begin to look at the commercial real estate market and where CAP rates are going in comparison to the 10-year Treasury.

When talking cap rate spread to 10-year Treasury 2022, historically, there has been a cap rate spread between CAP rates and 10-year Treasury yields, typically between 2-4%. This yield spread represents the additional risk associated with a real estate investment compared to a super low-risk investment like a government-backed bond. Multifamily and commercial real estate does not have a ceiling yield like a fixed-rate bond.

This is why investors will sometimes pay more or a lower CAP rate for multifamily as cash flows and residential and commercial real estate rents are expected to grow yearly, especially in an inflationary market. This means that the higher the expectation of growth rate in NOI will show up in the spreads between CAP rates and 10-year Treasury yields. Making the 10-year Treasury a good barometer of how investors feel about value moving forward.

Frequently Asked Questions About The Cap Rate Spread

The cap rate spread represents the delta between the 10-year treasury yield and what cap rate real estate is trading at. The spread tells us a story of risk, return and investors’ outlook on the economy moving forward as well as investor sentiment on income-producing real estate like multifamily.

Cap rate expansion is when cap rates rise, which as a result, lowers asset values. When cap rates compress or lower, each dollar of net operating income (NOI) is worth more, and when cap rates expand or increase, each dollar of NOI is worth less.

A 3% cap rate provides investors with a very low rate in-place return on closing, which generally tells us that the asset has a low level of risk. This indicates that cap rates are relative to the condition, location, and specific market you’re investing in.

Cap Rate Spread To 10 Year Treasury - Conclusion

The cap rate spread is the difference between the interest rate in the 10-year Treasury and the aggregate cap rate of real estate investments. The cap rate spread helps commercial real estate investors paint a picture of everything they need to know about the economic environment at a macro level. In the underwriting process, this information is helpful in helping assess the correct purchase price for a said transaction.

Whether you passively invest in a real estate syndication or a REIT, both vehicles generate returns from that cap rate spread between the cost of debt and the yield the property can perform at to make sense of the added risk.

This means that the higher the expectation of growth rate in NOI will show up in the spreads between CAP rates and 10-year Treasury yields. The larger the spread, the stronger the outlook.

Sources:

- Investopedia, “10-Year Treasury Note“

- Investopedia, “Understanding Treasury Yields and Interest Rates“

- CNBC, “U.S. 10 Year Treasury“

- AmericanCenturyInvestments, “Rates to Remain Anchored Until 2024“

Interested In Learning More About PASSIVE Real Estate Investing In Multifamily Properties?

Get Access to the FREE 5 Day PASSIVE Real Estate Investing Crash Course.

In this video crash course, you’ll learn everything you need to know from A to Z

about passive investing in multifamily real estate.

We’ll cover topics like earned income vs passive income, the tax advantages, why multifamily, inflation, how syndications work, and much much more!