Hyperinflation & Real Estate, The Relationship Between The Two

This article is part of our guide on buying real estate during a recession, available here.

Two things are instantly impacted by inflation and hyperinflation: short-term needs (such as energy and food) and credit. The impact on markets is clear-cut, but the effect on credit is more nuanced and intricate.

So, what else is there to know about hyperinflation and real estate? Well, a lot. In this article, we’ll help you understand everything you need to know about this relationship by defining hyperinflation, revealing countries that have experienced it, explaining what happens to real estate with inflation, and if it is good to own real estate during high inflation.

Key Takeaways

-

Hyperinflation is defined by rapid, excessive, and unchecked economic price hikes. While inflation gauges how quickly prices increase for goods and services in an economy, hyperinflation refers to inflation rising swiftly—typically by more than 50% per month.

-

People don’t desire products and services in hyperinflation; instead, they demand money for their products and services (rent).

-

In times of high inflation, rising housing prices or rental property rates are likely to be positive. As such, real estate can be a good inflation hedge.

-

Many people keep renting since high-interest rates reduce the buyers’ purchasing power, resulting in less purchasing volume.

Hyperinflation Defined

Hyperinflation is defined by rapid, excessive, and unchecked economic price hikes. While inflation gauges how quickly prices increase for goods and services in an economy, hyperinflation refers to inflation rising swiftly—typically by more than 50% per month.

By measuring the buying power of the greenback using the Consumer Price Index (CPI), the Bureau of Labor Statistics calculates inflation. The CPI is an index of prices for approximately 94,000 products and services, eight thousand rental housing unit estimates, and prices for clothing, home items, prescription pharmaceuticals, pre-owned cars, postage, and airline tickets.

The Federal Reserve typically works to maintain what it refers to as a healthy inflation rate of close to 2% over the long term. A high inflation rate is greater than 2%.

Hyperinflation is present when prices increase by more than 50 percent per month. When hyperinflation takes place, daily rises could reach 200% or more.

Although hyperinflation is uncommon in contemporary economies, it has frequently happened in countries throughout history. Some of these countries that have experienced hyperinflation are discussed next.

What Countries Have Experienced Hyperinflation?

As the world’s nations dabbled with fiat currencies guaranteed by the complete trust and credit of the authorities that issued them, hyperinflationary crises arose over the past century.

One such case is that of Zimbabwe. After Robert Mugabe’s land reforms of 2000–2001, during which land was mainly confiscated from white farmers and transferred to the majority black population, Zimbabwe saw a lengthy, grinding decrease in economic output. Over the subsequent nine years, output fell by 50%.

Inordinate government budget deficits were caused by socialist reforms and a costly commitment to the Congo’s civil war. The population of Zimbabwe was also falling as individuals left the nation at the same time. As a result of these two conflicting factors—increased government expenditure and a shrinking revenue base—the government was forced to monetize its fiscal deficit.

All of this led to several years of hyperinflation. The Zimbabwean dollar’s value had fallen so low by the time its hyperinflation period was over that it had to be substituted with several foreign currencies.

Another example of hyperinflation is Venezuela. According to the International Monetary Fund, the country’s consumer prices increased at a startling rate of more than 65,000% between 2017 and 2018. (IMF). By 2020, it had decreased to just 2,360% per year.

Venezuela’s money and economy were obviously in crisis, and its citizens were in severe distress, given that central banks like the U.S. Federal Reserve (Fed) and the European Central Bank (ECB) strive for annualized targets of roughly 2%-3%.

What if such hyperinflation was to occur in the United States? What can you do to minimize its impact on you and your family? Is real estate investing an excellent way to do that? What happens to real estate with inflation? We will look to answer these questions below, starting with the last one.

What Happens To Real Estate with Inflation?

You must understand this to understand the relationship between hyperinflation and real estate. The amount of cash flow a property generates after its operating expenses determines the property values in a market. It indicates that real estate prices may appreciate or stay comparatively stable to the inflation rate during hyperinflation.

People don’t desire products and services in hyperinflation; instead, they demand money for their products and services (rent).

Is It Good to Own Real Estate During Inflation?

When the U.S. Treasury produces too many dollars too quickly in cooperation with the Federal Reserve, it is one of the quickest ways to unleash unchecked inflation. The buying power of the dollar diminishes by inflation. However, inflation can be favorable for assets like real estate because of its intrinsic value and the ability to increase rent annually to keep up with inflation.

In times of high inflation, rising housing prices or rental property rates are likely to be positive. As such, real estate can be a good inflation hedge. Getting a mortgage could be challenging in times of a high inflationary environment. Many people keep renting since high-interest rates reduce the buyers’ purchasing power, resulting in less purchasing volume.

The increase in demand results in higher rental rates, which is great for landlords. Property or rental prices typically increase in an inflationary environment, even though the rise is a unique and distinct housing market study.

Regardless of your financial situation, people still need a roof over their heads. Real estate, therefore, has intrinsic value.

Real estate investors benefit significantly from hyperinflation. Post-pandemic, where we’ve seen inflation hit 40-year highs, real estate appreciated by more than 40% in some markets across the United States. This is why real estate investing is highly recommended to minimize the impact of hyperinflation.

Related Read: What is the Best Hedge Against Inflation?

Frequently Asked Questions about Real Estate in Hyperinflation

In hyperinflation, the best assets to own are real estate assets, particularly multifamily properties. You can earn real estate income from them even in hyperinflation. Other assets that do well in hyperinflation include lumber, oil, metals, gold, and agricultural products.

Homeowners typically benefit more from hyperinflation than low inflation in terms of increased property value.

Hyperinflation Real Estate – Conclusion

Given that real estate is less volatile than the stock market, investing in tangible assets like real estate might help insulate you against rising inflation. It’s essential to not just invest in any type of real estate. The focus should be on cash flow producing real estate in markets with strong fundamentals.

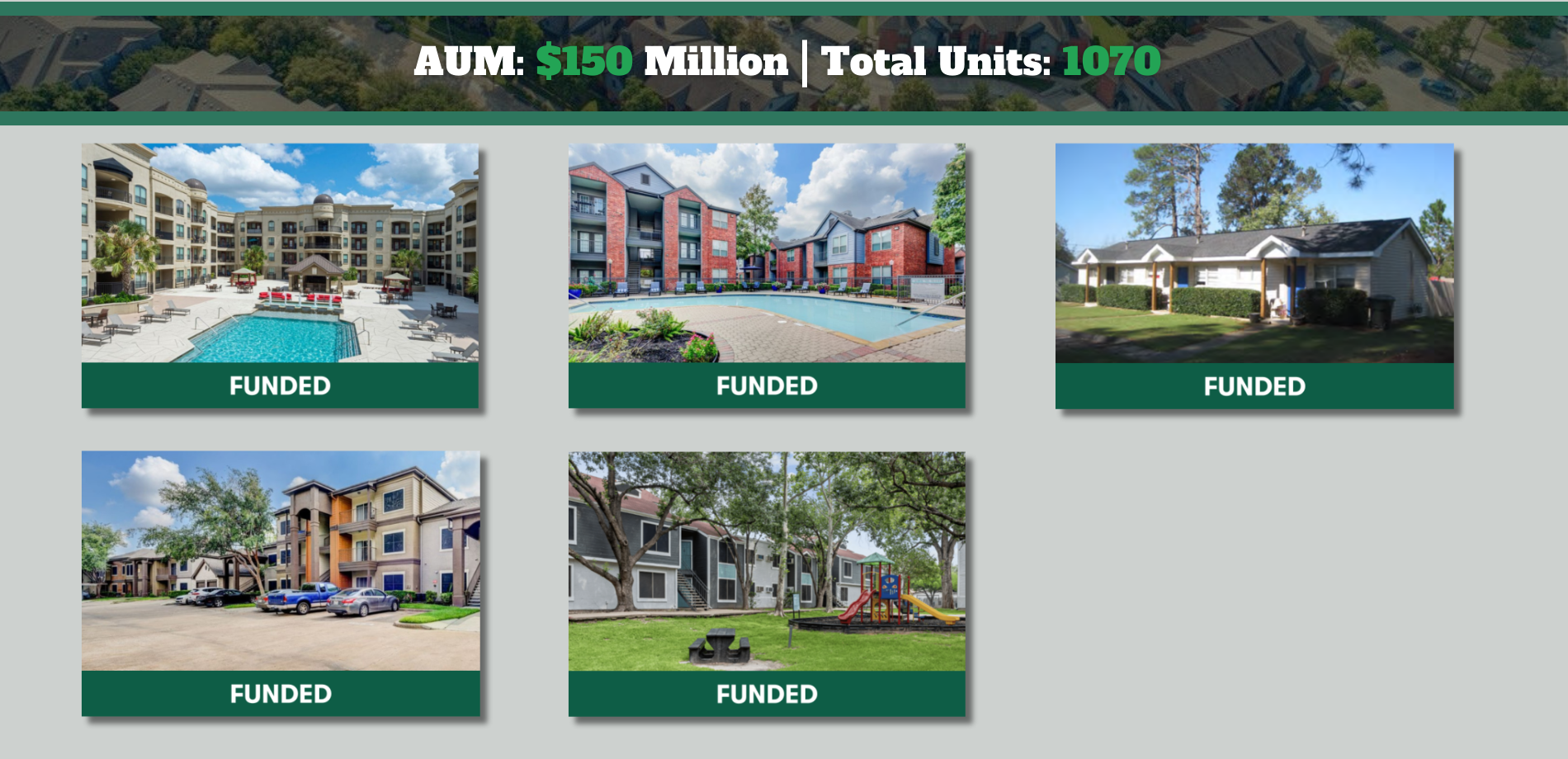

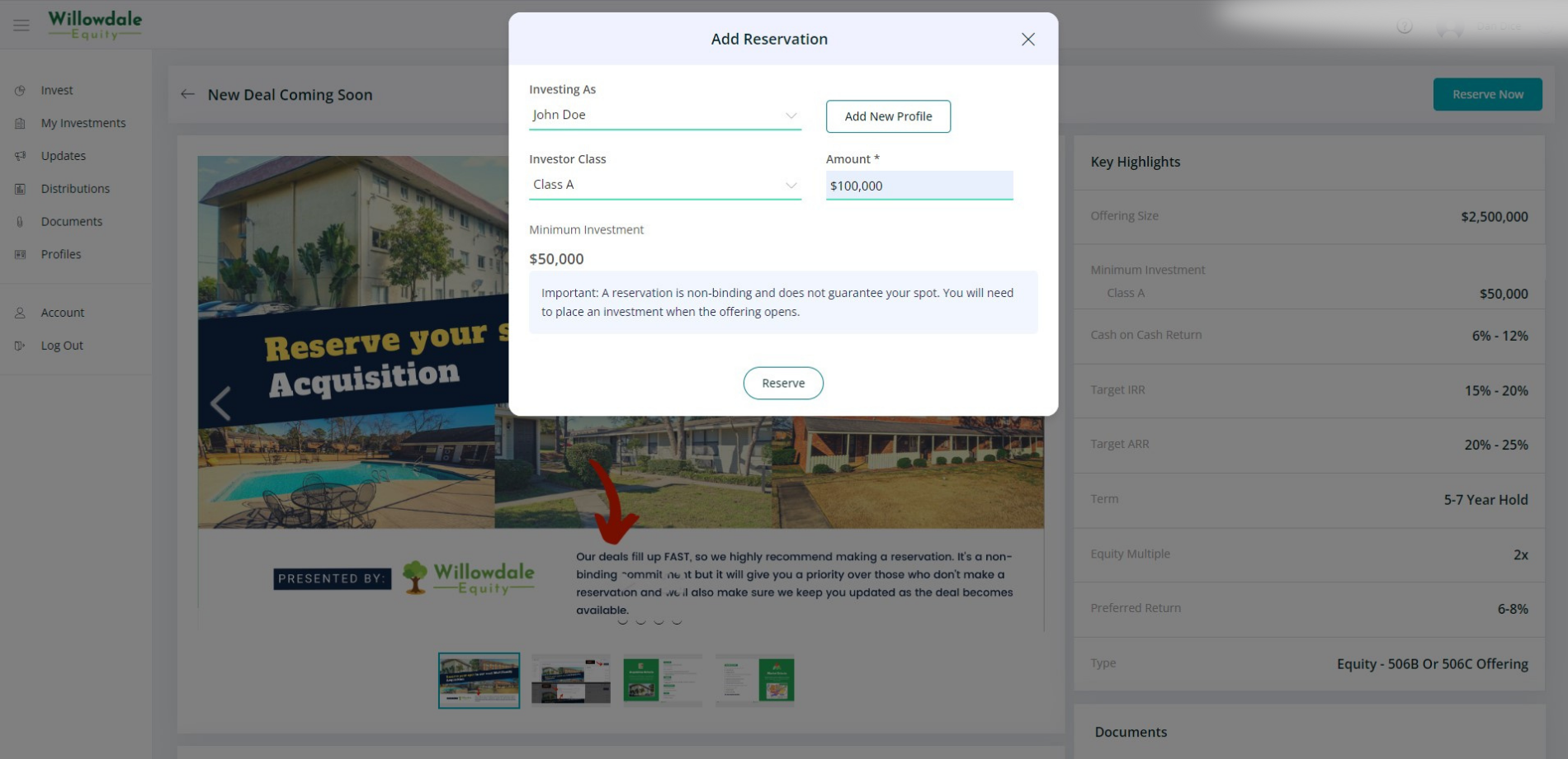

Join the Investors Club here at Willowdale Equity to access private cash-flowing value-add multifamily real estate investments that help protect you against rising inflation.

Sources:

- Investopedia, “What Is Hyperinflation? Causes, Effects, Examples, and How to Prepare“

- Investopedia, “Worst Cases of Hyperinflation in History“

The Willowdale Equity Investment Club is a private group of investors that are looking to passively grow their capital and share in all the tax benefits through multifamily real estate investments.