What is a Good ROE for Real Estate?: Return on Equity, The Overlooked Return Metric

This article is part of our guide on what a good IRR is for multifamily, available here.

When a real estate investor analyzes a property, it isn’t enough to look at its cap rate and base purchase decision solely on that metric. Instead, investors should analyze a property’s finances more thoroughly using a variety of metrics.

One such metric is a property’s return on equity or ROE. This metric can help investors see how much a property is yielding and how that yield is related to equity in the property.

Key Takeaways

-

The return on equity in real estate is the percentage return on an investor’s equity in the property.

-

To calculate a property’s return on equity, divide the property’s net annual cash flow by the amount of equity. (Net Annual Cashflow / Equity)

-

A good ROE depends on your market. Generally, as with ROI, the higher the better. For most markets in the United States, an ROE of 2-5% or more would be considered good.

What is the ROE (Return on Equity)?

The return on equity in real estate is the percentage return on an investor’s equity in the property. This allows investors to see the return on their equity stake in a property to optimize their holdings better, especially if they have a portfolio of properties.

The return on equity is almost always going to be higher when leveraging real estate with the help of bank financing than by simply buying a property outright with cash unless your purchasing in a high-interest rate environment. In a high-interest rate environment, your debt service is much higher and eats up a large majority of your cash flow.

How Do You Calculate Return on Equity (ROE)?

To calculate a property’s return on equity, divide the property’s net annual cash flow by the amount of equity.

(Net Annual Cashflow / Equity)

Suppose you purchase a $500,000 property, financing $400,000 and putting down $100,000 cash. The property’s net income is $750 monthly or $9,000 annually. By dividing the property’s net annual income by the equity position in the property, the result is an annual return on equity of 9%.

But what is a good ROE?

Suppose you purchase a $500,000 property, financing $400,000 and putting down $100,000 cash. The property’s net income is $2,000 monthly or $24,000 annually. By dividing the property’s net annual income by the equity position in the property, the result is an annual return on equity of 24%. That’s much better than if the property was purchased using all cash. In that case, the property return would be just 4.8%. This is the power of leverage in real estate.

But what is a good ROE?

Return on Equity Calculator

Below is an ROE calculator. Simply input the desired numbers and click “Calculate” when your finished.

What is a Good ROE for Real Estate?

A good ROE depends on your market. Generally, as with ROI, the higher the better. For most markets in the United States, an ROE of 2-5% or more would be considered good. However, in a place like New York City, it’s doubtful you’ll have such a high ROE as yields are low and initial equity requirements are high.

For example, it’s highly unlikely that you will be able to purchase a commercial property in New York City with less than a 30% down payment. However, there are some less competitive markets where a lower down payment is possible, boosting the investment’s initial ROE.

If an investor is looking to balance risk and capital appreciation, smaller markets will likely be a better opportunity than a crowded one. These smaller markets will yield a better ROE and a better ROI (return on investment). What might be an acceptable return in New York would probably be considered bad in Tampa.

Related Read: The AAR in Real Estate Investing

Which is Better ROI or ROE?

ROI and ROE are different. ROI stands for return on investment, and this metric helps investors determine how the property performs based on their initial investment. Equity and the amount you invested in a property are not the same. The shareholders equity in a property should increase as you pay off your mortgage over time and as the property appreciates over time, whereas the amount you invested in the property at the beginning is fixed.

Over time, these two figures will begin to converge, at which point some investors might sell the property and purchase several additional properties with leverage, keeping their ROE high. Some investors, however, are more comfortable holding the same property for a long time, collecting cash flow even though the return on equity is lower.

There is an alternative to selling a property and replacing it. Instead, an investor with very high equity in a property can borrow against it and use that money as a down payment for a new property. This allows the particular investor to keep their original property while increasing their capital return and growing their portfolio. The transaction costs for refinancing will likely be less than selling.

What are the Limitations of the ROE Calculation?

The main problem with the ROE calculation is that it doesn’t take a property’s future appreciation. While cash flow is usually the most important feature of an investment property, not all investors look at cash flow as their primary indicator of success.

Instead, in some markets, it may be more important to look at the property’s appreciation over time, mainly if it’s located in a rapidly growing area. Instead of holding the property over many years, an investor may want to hold it for five years, sell it, and take advantage of the accelerated gains.

Frequently Asked Questions About ROE in Real Estate Investing

An ROE of 20% means that a property generates a 20% annual return on the property’s equity.

A high ROE is better than a low one. However, as a property is paid off over time, its return on equity will inevitably decrease as equity in the property increases.

A Good ROE for Real Estate - Conclusion

Now that you’re familiar with the ROE, you’ll be able to use it along with other metrics to analyze a potential real estate investment. It is important to optimize return on capital, and the ROE can help you decide when it’s time to exit a property.

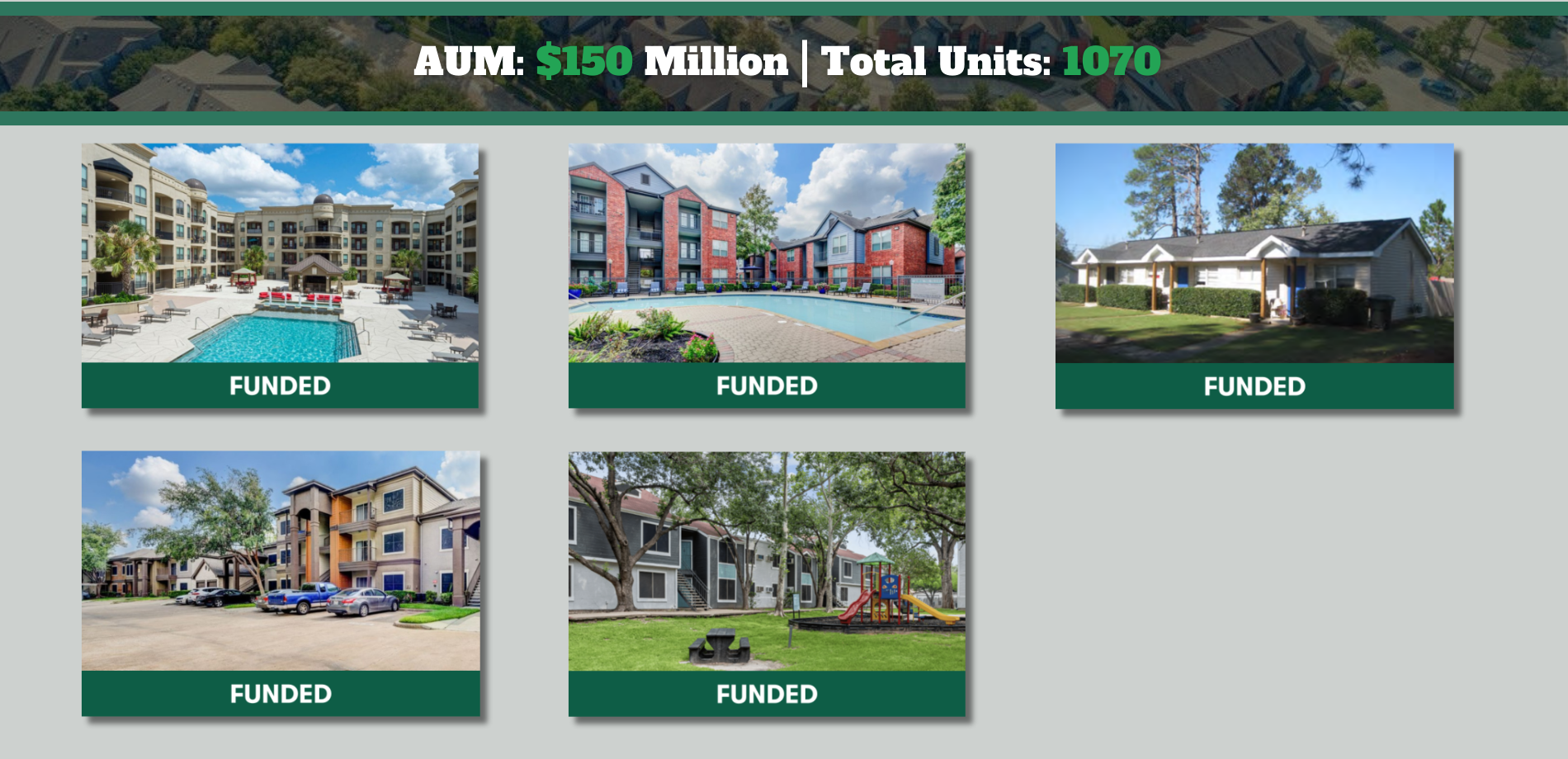

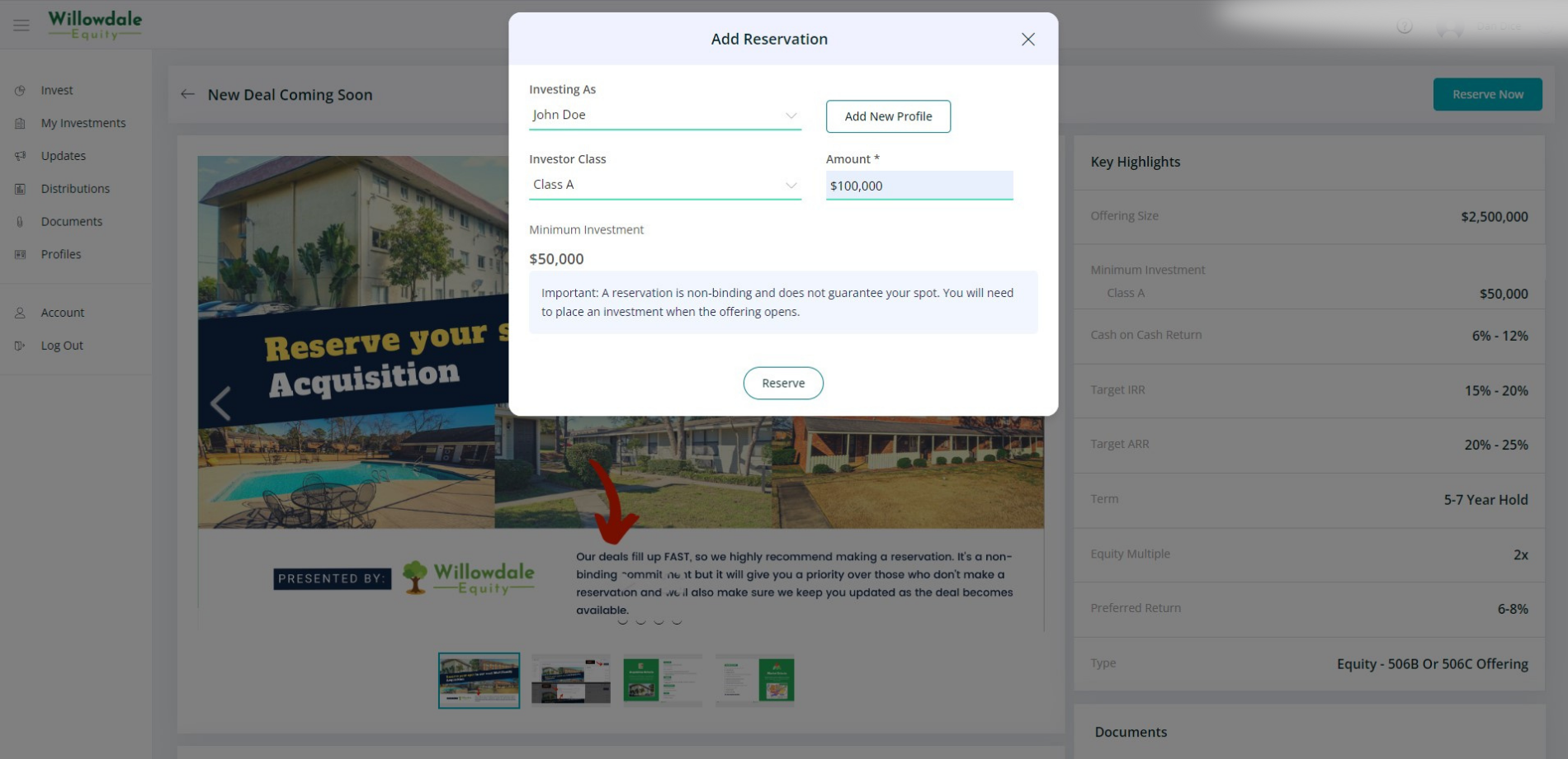

As an investor, it’s always better to work with others. That’s why you should consider joining the Willowdale Equity investor club. You’ll get access to our resources and exclusive multifamily real estate syndication opportunities there.

Sources:

- TheBalanceSmallBusiness, “Return on Equity in Real Estate Investing”

- Leverage.com, “What is a Good Return on Equity (ROE)?”

The Willowdale Equity Investment Club is a private group of investors that are looking to passively grow their capital and share in all the tax benefits through multifamily real estate investments.