Analyzing A Multifamily Deal In Under 10 Minutes

This article is part of our passive investors guide on real estate syndications, available here.

It’s not simple to perform a multifamily deal analysis in less than 10 minutes. Incredibly if you haven’t fine-tuned your approach and don’t know exactly what you need to look for before going any further. In a competitive market (which we’re currently in), you need to be able to provide prompt feedback to brokers as they are the gatekeepers of multifamily deal flow. That means you need to be able to do a quick preliminary dive into a deal, fast, to let the broker know where you stand.

Key Takeaways

-

To scale up your acquisitions and not succumb to “the fear of missing out” or FOMO, you need to be objective about the process. That means that not every deal will work, and that’s okay.

-

Verify actuals and not proformas, meaning we want to do a quick underwriting of the financials on a multifamily deal, plugging into our underwriting models the actual numbers from the financials.

-

The top-level numbers must make sense in order to progress further in expressing interest and further pursuing a deal.

-

Sometimes in real estate investing, we need to take a step back and remind ourselves that this is a marathon, not a sprint.

Here at Willowdale Equity, there are six things we do to analyze a deal in under 10 minutes quickly, and they are:

- Underwrite 100 deals to find 1

- Value-Add Upside

- Strong local rent growth

- Verifying Actuals and not Proforms

- Going in CAP and Market CAP

- Do the numbers work?

How to analyze multifamily investment opportunities - As a real estate investor, you must do the following:

1.) Underwrite 100 deals to find 1

To scale up your acquisitions and not succumb to “the fear of missing out” or FOMO, you need to be objective about the process. That means that not every deal will work, and that’s okay. A sponsor/syndicator should have an elicit criterion of what checks the box for a deal and stay loyal to that. You can be flexible and adjust to market conditions but not fall prey to doing the wrong deal. For us, that means underwriting over 100 deals to find the one that works.

Now that doesn’t necessarily mean that we don’t make offers on 20 out of 100 or vice versa; it simply means that we know this is a numbers game and that the right opportunity will present itself if we’re patient enough. You can’t just appear on your terms; you have to be rubbing shoulders with brokers, making offers, and showing intent, and only then will you be taken seriously.

2.) Value-Add Upside

We like to see a value-add component to a deal, but every group has its criteria and risk and return profiles for a deal. Examples of value-add opportunities in a deal could be upgrading legacy unit finishes to newer finishes, implementing a water conservation program to cut utility bills, adding new community amenities like a dog park and a pool, reducing operating expenses, and much more. These items allow us to either reduce our costs which brings up our income and value or will enable us to increase rents which also brings up our income and value.

Some sponsors like to take down the core and core-plus multifamily properties, which are, in a nutshell, much newer built properties generally 0-20 years old, in class A and B locations with little to no value-add upside but present a much low-risk profile.

3.) Strong local rent growth

If you’re evaluating a deal in a new submarket, then there’s a chance that you don’t already have these numbers. A healthy market sees 2%-3% year-over-year rent growth, but for example, a major MSA like Atlanta has seen so far on the year 6% rent growth, but a submarket of Atlanta may have seen 10% rent growth. Diving into the micro submarkets and understanding where rents are trending will be a good meter of growth potential.

A C-Class property in an excellent location will often produce more rental income than an expensive place not in a great area. That’s because tenants are willing to pay for the benefit of being close to things they want, like restaurants, shops, or work.

4.) Verifying Actuals and not Proformas

This means we want to do a quick underwriting of the financials on a multifamily deal, plugging into our underwriting models the actual numbers from the financials. Not the assumptions a broker may have put together in an Operating Memorandum (OM), the deck brokers put together to market the deal.

Take it a step further and underwrite the deal with your assumptions. For example, if the expense ratio is very low on a deal, let’s say it’s only showing a 30% expenses ratio, which means that for every $100,000 of gross rental income, there are only $30,000 in operating expenses. We can underwrite the deal with a more normalized expense ratio, like 40%-50%, to see if the numbers still work.

Additionally, we want to stress-test the deal in our underwriting to see the “Breakeven” Occupancy Rate and whether it’s reasonable. We want to figure out how many of these units need to be occupied monthly for this deal to work.

So on an annual basis, if we bring in $3,000,000 in gross income across a 100-unit apartment community, and let’s say the operating expenses were $1,350,000 and the debt service on loan was $675,000. With these numbers, we can calculate our breakeven occupancy rate the following way > ($1,350,000 + $675,000) / $3,000,000 = 67.5%.

It’s best to start looking at what similar properties are getting for rent or how much rent other similar properties are asking for their units. It’s important to ensure that we can fill the multifamily property with the right type of tenant and note how much we’ll need to raise each year to achieve our return expectations.

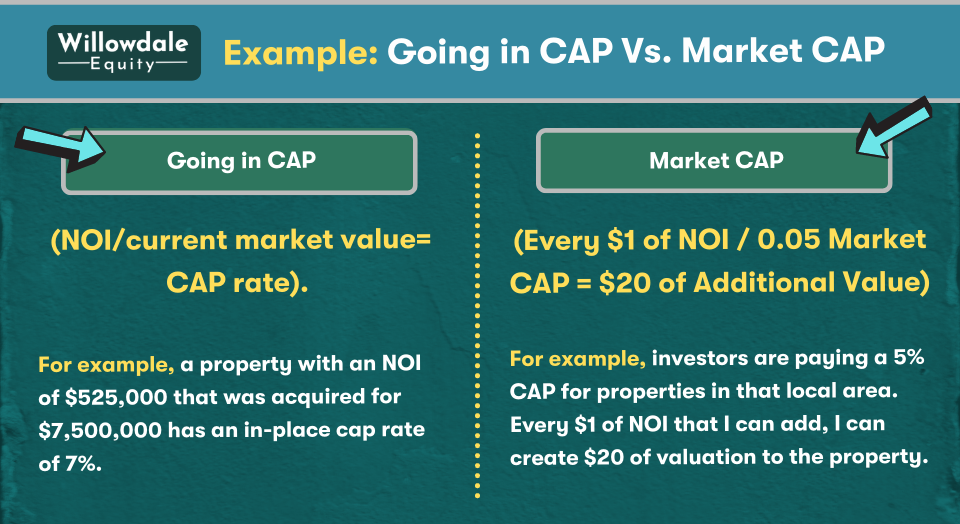

5.) Going in CAP and Market CAP

The capitalization rate is the return on investment calculated using the projected income for a multifamily property. The formula for calculating the CAP rate is (NOI/current market value = CAP rate). You must divide the net operating income (NOI) by the current market value.

For example, A property with an NOI of $525,000 acquired for $7,500,000 has an in-place CAP rate of 7%.

Identifying and comprehending the market for a real estate deals submarket necessitates more thorough research through conversations with local brokers, owners, and lenders and examining sales comps to assess what properties are being traded for. Understanding how value is calculated and pushed through strategic capital improvements and vital operations is critical to evaluating a market’s CAP.

What the market CAP tells us is that investors in this specific area are willing to accept “X’ yield on their cash.

For example, comparable multifamily properties in a submarket sell for a 5% CAP. I can acquire a property with a 6% CAP in a crowded area because I’ve found some deferred maintenance concerns that must be addressed. This would reflect a delta of 1% between both CAP rates; this also means that I may add $20 in value to the property for every $1 of net operating income (NOI) I can generate. (Every $1 of NOI / 0.05 Market CAP = $20 of Additional Value)

6.) Do the numbers work?

This is a pretty simple underwriting rule, at the end of the day we don’t purchase these large assets as a passion project, they are acquired to produce a strong risk-adjusted return for real estate investors. That means that we can’t be buying multifamily real estate investments on speculation or because of the pride of owning a beautiful investment property in the best location. The top-level numbers must make sense in order to progress further in expressing interest and further pursuing a deal.

The underwriting of the deal’s numbers on the front end will save us a lot of trouble in the future.

Unlike single-family homes, multifamily homes are cash flow machines for investors to produce long-term wealth via cash flow or appreciation (hopefully both). The equity position an investor takes will likely be funded by bank financing – how does the underwriting look like on the debt side?

As you can imagine, there are dozens of reasons why this rule number may not apply to every deal; but if we’re not comfortable with how the investment will get paid back it should raise some flags about how well-positioned that investment is to produce returns.

Frequently Asked Questions About How To Analyze Multifamily Investment Opportunities

“Multi-family” is the industry term for apartments. Many great tools make appraising multi-units easier, like an appraisal calculator (to generate a general estimate). But ultimately, to get an accurate value, you need to consider comparable purchase prices and rents of other properties nearby before coming up with any value conclusion.

Running comps for an apartment complex is not as easy as running comps for a single-family home, for example, as apartment sales data is not publicly accessible online. One of the ways to run comps is to pay for an aggregated data provider like Co-Star, but the downside to this approach is that data providers of commercial sales data are costly. The best way is to form a relationship with a local commercial real estate broker in the market you are looking to do a deal in and ask them to provide you with a recent sales report of your desired sub-market. Most commercial real estate brokers will access these data providers through their brokerage.

As a general statement, we believe the multifamily asset class is always good to purchase anytime in the real estate market cycle. We believe this to be true as the demand for apartment units nationally continues to increase as significant supply issues continue to be an issue across the United States.

Also, labor and material costs are expected to continue to rise, making building new more expensive and unrealistic for some developers. As a result, this increases the value of existing buildings. Inflation is also a big reason to be bullish long-term on multifamily as prices will continue to rise. This means rents will continue to grow, and as a result, landlords will collect more income from tenants, and values will further appreciate. The best time to buy a multifamily property was yesterday!

Underwriting a multifamily property can be very complex, and you must know what you’re looking for. The first place to analyze would be the local market in which that property resides. You’ll look at local market data such as the vacancy average, number of units to come online, population size, population migration, top employers, school ratings, and much more.

Then you can focus on the subject property and underwrite the properties existing numbers to validate their accuracy. That includes items like the existing vacancies, collections averages, current market rents vs. market rents, how much you’ll need to make improvements, and much more!

How To Analyze Multifamily Investment Opportunities - Conclusion

If you follow these six things, you will be able to identify opportunities much quicker and save yourself from deep-diving into a deal that you could have quickly ruled out within minutes. Sometimes in real estate investing, we need to take a step back and remind ourselves that this is a marathon, not a sprint. We must remain clear on our criteria and what we’re going after and then build and optimize our processes to be as efficient as possible.

On acquisition, your multifamily investing strategy should involve adding value to the tenant base and the physical property. When you do this, the net result should be that additional Net Operating Income (NOI) will be added to the bottom line.

This means your property is worth more and has more built-up equity, and the next real estate investor is willing to pay for more cash flow. This is why your multifamily investments need the right on-site property manager and property management team to run the day-to-day operations to carry out your business plan.

Interested In Learning More About PASSIVE Real Estate Investing In Multifamily Properties?

Get Access to the FREE 5 Day PASSIVE Real Estate Investing Crash Course.

In this video crash course, you’ll learn everything you need to know from A to Z

about passive investing in multifamily real estate.

We’ll cover topics like earned income vs passive income, the tax advantages, why multifamily, inflation, how syndications work, and much much more!