Investing in Apartment Buildings: 14 Ways to Add Value to An Apartment Building

This article is part of our passive investors guide on real estate syndications, available here.

Value-Add Apartment Investing

Value-add real estate investing in the multifamily game requires a solid ability to identify opportunities to add value. Other competing groups may even overlook these strategies. Thus creating an advantage in seeing the deal through a different lens than your competitor and allowing you to make sense of the numbers when they possibly couldn’t.

Creating value doesn’t just come from implementing a strategy that produces more income; it can also come from implementing a strategy that reduces expenses. In the simplest explanation, value is created by increasing the net operating income (NOI); our job as active investors is to increase this number by adding income and/or reducing expenses.

Even if you’re a passive investor, and you’re not necessarily paid to create the business plan and identify these value-add opportunities, you should still understand the functions of how value is truly added. Understanding this core concept arms you, the passive investor, with the ability to truly analyze the business plan and the opportunity that lies within the deal.

Key Takeaways

-

Investing in an apartment building needs careful consideration of whether or not it’s the right fit for your goals and expectations.

-

The market value for an apartment community is determined by the market capitalization rate (Market CAP). The market value of an apartment tells us what rate of return investors are willing to get on their invested capital on an acquisition in a given market.

-

Things like local economic drivers, the property’s age, in-place rents, and market rents are some factors that make up that local market CAP.

-

The ability to identify ways to add value and execute your strategy is the lifeblood of the multifamily real estate business.

Investing in Apartment Buildings:

Investing in apartment buildings is a popular choice for many people because they typically provide a more significant return on investment but require more work.

Investing in an apartment building needs careful consideration of whether or not it’s the right fit for your goals and expectations. Some of the main points you should consider include: your experience with property management, what you can afford to put down as an initial investment, and how much time and energy you have to commit to day-to-day activities such as regular maintenance, problem-solving, and tenant relations issues.

Fortunately, you can learn a lot of free information here at the Willowdale Equity Blog that can help educate potential investors about the benefits and challenges of entering the business. Luckily we provide passive investment opportunities for individual investors to invest alongside us without having to do any of the aforementioned.

How to value an apartment building

To identify and understand how to value an apartment building, it’s crucial first to understand the capitalization rate (CAP) and how that helps you arrive at your value.

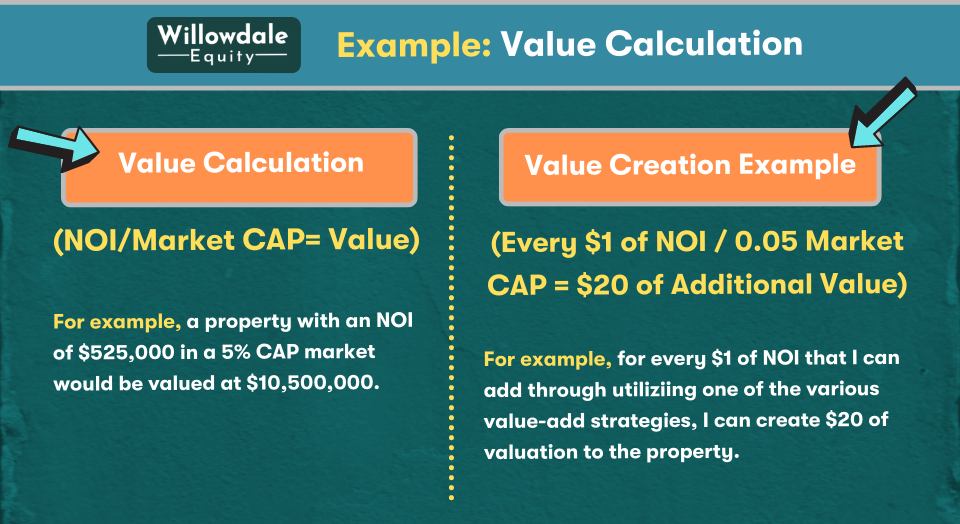

The CAP is a measure of financial return based on the anticipated rental income of the property. The CAP rate is determined by dividing NOI by the following calculation (NOI / current market value = CAP rate). For example, let’s say we have a property that produces an NOI of $525,000, and it was purchased for $7,500,000. That would mean that the property has a 7% in-place CAP rate.

Identifying and comprehending a deal’s submarket’s market capitalization rate requires more in-depth research with local brokers and owners and comparing sales comps to see what properties are selling for. Determining and measuring how value can be forced through smart capital improvements and vital operations requires understanding the market CAP.

The market CAP shows us what local investors are willing to pay for a multifamily property in that particular community. For example, let’s say that comparable apartment communities in a local submarket are selling for a 5% CAP. That means, for each $1 of net operating income (NOI) I can improve, the property has an additional $20 of market value (Every $1 of NOI / 0.05 Market CAP = $20 of Additional Value).

Related Read: Core vs Core Plus Investing

Net Operating Income (NOI)

Gross Income – Operating Expenses is how you get to your NOI. You may reduce your costs to increase your NOI and add value by increasing revenues, which is why optimizing operations and reducing expenses will help you boost income. The greater your NOI, the greater the property is worth to investors since they are prepared to pay more for more yield.

For example, let’s say you collect $100,000 in rent every month and the operational expenses needed to operate the property are $40,000. You’d be left with $60,000 of NOI ($100,000 – $40,000=$60,000 NOI). On an annual basis that would work out to $720,000 NOI ($60,000 NOI X 12 Months= $720,000 NOI)

NOTE: Whomever the next buyer is of the property, they would likely finance it with new debt when they purchase it. This is why your NOI does not include your mortgage payment.

(NOI / Market CAP= Value)

Apartment Building Value Calculator

Enter the Net Operating Income (NOI) and the Market Capitalization Rate:

How To Add Value To An Apartment Building: Renovations that Increase Appraised Property Value

The list below will explain how we add value to an apartment community.

1.) Tech Upgrade

Depending on the tenant demographic of an apartment community, adding a tech package to the units may add a lot of value and allow you to charge rental premiums for it. A tech package includes keyless locks, smart thermostats, water usage management systems, and an Amazon Alexa system to connect to all residents’ devices.

As consumer trends continue e to evolve, more and more apartment buildings will come equipped with these types of tech amenities. Eventually, they will become a standard the tenants begin to expect.

2.) Washer/Dryer

Add a washer and dryer in all or select units, or create a communal washer and dryer for residents. The convenience of having a wash and dryer without having to leave your unit is very appealing to residents. It’s not the best experience having to lug your clothes and sit there while your private undergarments are being cleaned around strangers.

3.) Upgrade Appliance Package

Residents are very receptive to new black or stainless steel appliance packages; having this allows you to charge a rental premium.

4.) Parking

If your apartment community has the parking ability to do so, you can add a paid VIP parking area for residents.

5.) Pet Fees

Charge a monthly flat fee for residents that have a dog or cat; for example, create a pricing tier based on the weight of the dog.

6.) Move-in-fee

Charging a flat move-in fee to residents upon move-in can also be used to push a prospective tenant over the line to get that new lease. This can be done by offering to waive this move-in fee as a concession.

7.) Flat Water fee Or Ratio Utility Billing System (RUBS)

Charge a flat fee for water to tenants or implement a RUBS program that would allow you to charge back a portion of the utility bill to residents based on an estimation of their use.

Submetering is another alternative way of achieving the same thing, but it is very costly, and, in most cases, it might not make sense economically.

8.) Private Backyard Fencing

Help enhance the resident’s lifestyle by adding private backyard fencing to select units to give residents more privacy.

9.) Dog Park

Add a designated dog park where residents can walk and play with their furry friends. This is a low cost common amenity that you’ll see at most garden-style apartment communities and an easy way to increase your resident’s experience.

10.) Adding or Upgrading Community Amenities

When investing in apartment complexes, a robust amenity package at an apartment complex is becoming more and more of a deciding factor for prospective tenants. Adding amenities like a dog park, children’s park, pool, BBQ area, patio area, fitness center, and a business center could allow you to charge higher rental premiums and create more demand for units.

In the most recent surveys that asked apartment residents nationwide what would justify them paying more for rent, the majority said they would pay more if the apartment community had a robust amenity package.

Amenities will continue to be a significant driver of value, and tenants will continue to demand strong amenities from their landlords.

11.) Storage Units

Some people are hoarders and always need more space than they have, adding climate-controlled or non-climate-controlled storage units would allow residents to have a place to put their extra belongings.

Storage units are attractive because they’re very similar to apartment units in the sense that people need them and will rent them every month, but the beauty is they require relatively low maintenance to operate.

12.) Billboard

Depending on your property’s location and layout, it may make sense to grab some additional monthly income by adding a billboard sign for advertisers. This strategy is usually very effective if you have a property located in a major metro with high daily traffic volume.

13.) Upgraded Interior Finishes

For most older vintage properties, usually older than 1990, this value-add item is a big low-hanging fruit to add additional net operating income.

In most value-add deals, all units, or a percentage, have outdated legacy interiors and need upgrades. Upgrading the interior unit includes new luxury LVT flooring, new or resurfacing countertops, cabinets, new vanities, new fixtures, fresh paint, and much more.

14.) Water Conservation

In older-built apartment complexes, the toilets, shower heads, and aerators degrade over time. Being that these items are no longer operating efficiently, they can increase your utility bill quite substantially.

Optimizing and changing these items out can reduce the utility bill by as much as 40% in some cases.

15.) Enhanced Security Measures

Investing in security upgrades such as surveillance cameras, gated access, or security patrols can improve tenant safety and peace of mind, making the property more attractive to prospective renters and potentially commanding higher rental rates.

16.) Community Engagement Programs

Establishing community events like barbeques or services like fitness classes, educational workshops, or social gatherings can enhance resident satisfaction and retention. This leads to lower turnover rates and higher perceived value for the property.

17.) Energy Efficiency Upgrades

Implementing energy-efficient features such as LED lighting, solar panels, and low-flow plumbing fixtures (which we touched on in “14.) Water Conservation”) can significantly reduce utility costs over time, thus increasing the property’s net operating income (NOI) and overall value.

What determines market value of an apartment?

The market value for an apartment community is determined by the market capitalization rate (Market CAP). The market value of an apartment tells us what rate of return investors are willing to get on their invested capital on an acquisition in a given market. Things like local economic drivers, the property’s age, in-place rents, and market rents are some factors that make up that local market CAP.

The metropolitan area in which it’s located, the type of neighborhood, and many other characteristics also influence values.

For example, an apartment in a fancy neighborhood might be more expensive than one in a “rougher” area because people view it as safer and often associate nicer neighborhoods with better education. Other times folks will pay more for proximity to work.

Frequently Asked Questions About How To Value An Apartment Building

It all depends on what asset class of real estate we’re talking about. But generally, real estate appreciation keeps pace with inflation or beats it. National appreciation values for homes move up about 3%-4% every year, but in 2021 we saw 15% appreciation nationally, and in some select markets across the United States, we have seen 30%- 40% plus appreciation.

Yes, apartments increase in value over time primarily due to the building’s ability to produce more cash flow yearly as rents naturally increase. Also, it’s important to note the location of where the produce resides highly influences the rate the value increases over time.

A value-add apartment community is a property that has the upside through operational and physical improvements to increase the building’s valuation.

To calculate the value of an apartment building, you need to know two numbers: the property’s net operating income (NOI) and the local market capitalization rate (Market CAP). Once you have those two numbers, you will use the following formula (NOI/Market CAP= Value). For example, let’s say the NOI is $300,000, and in the particular submarket where the property is located, the market CAP is 6.5%. Here’s how that would look> $300,000/0.065=$4.6MM.

Investing in Apartment Buildings - Conclusion

The ability to identify ways to add value and execute your strategy is the lifeblood of the multifamily real estate business. Whether you are an accredited, non-accredited, or sophisticated passive investor, you can use this guide to help you better evaluate your next investment opportunity. It is important to note that having all the money upfront to perform renovations, being well-capitalized, and having curb appeal are critical factors to the project’s success.

To achieve extra cash flow, there are many other ways to add value to an apartment building outside of what is listed above. But it’s important to note the tenant demographic and class of the property to properly evaluate which type of value-add items make the most sense and would provide the highest yield.

Key Highlights

📈 Increase in Value After 15 Months – 80%

📈 Increase in Value After 21 Months – 119%

📈 Return of Investors Capital on Refinance – 62.5%