Cost to Build an Apartment Complex in 2024: Apartment Building Cost Calculator

This article is part of our passive investors guide on real estate syndications, available here.

As a real estate investor, you’ve probably thought of getting your hands dirty in property development. Since this is a new experience, you’re probably wondering how much it costs to develop an apartment complex in 2024.

For a newbie, the process of building an apartment complex can be overwhelming. There are many soft and hard costs, many contractors to work with, and sometimes many hidden fees. If not careful, the entire project can exceed your budget.

However, this shouldn’t discourage you. Once you’ve done your research and followed due process, apartment development can be a breeze. Luckily, we’ve done all the heavy lifting and developed this comprehensive guide to help you understand what it takes to develop an apartment complex.

Key Takeaways

-

The average cost per square foot to build an apartment complex in the U.S. is $310. However, this cost varies depending on your location. Also, these figures are based on the development of mid-rise apartments and condos.

-

Building a single unit in an apartment complex would run you around $80,000 to $280,000 per unit.

-

With the housing shortage, apartment construction could increase to help close the housing shortage gap. It may also delay some projects as rising rates continue to squeeze developers as their burn rate on borrowed funds increases.

Cost Per Square Foot to Build an Apartment Complex

The average cost per square foot to build an apartment complex in the U.S. is $310. However, this cost varies depending on your location. Also, these figures are based on the development of mid-rise apartments and condos. For starters, mid-rise buildings are typically between 5 and 10 stories.

Remember that the cost per square foot is essential in helping you develop your building budget. However, this estimation doesn’t give you a clear insight. This is because investors, developers, and contractors must account for the different costs influencing the cost-per-square-foot estimate. These costs include:

- Hard Costs: These are the costs that purchase or hire building land, materials, equipment, labor, utilities, site work, and other expenses directly related to apartment building construction.

- Soft Costs: This refers to the money that goes into paying for building permits, licenses, taxes, architectural designs and drawings, inspections, and engineering. Land can also be considered a soft cost, and a typical lot could range from $1,500 to $200,00 per acre. As you can see, these costs aren’t directly related to the actual building of the apartment complex.

- Finance Costs: These are the costs associated with borrowing money to construct the apartment complex. These costs include processing fees, interest, and finance charges. They are paid to the lender, whether banks or other investors.

- Long-term Costs: These are the monthly or recurring expenses for maintaining the building’s utilities and systems. They include expenses for the apartment’s elevator, swimming pool, laundry equipment, and many other amenities. It’s hard for an investor to estimate the cost per square foot for these expenses, but you need to keep them in mind.

Also, you don’t want to be caught flat-footed by unforeseen circumstances. This is why investors, developers, and project managers need to have a budget for delays, disputes, and other miscellaneous costs. Remember that lawsuits and payment disputes can lead to project delays and failure.

What is the Average Square Foot of an Apartment Unit?

The average sqaure foot of an apartment unit varies dependending on the unit type. The following breaks down the average size per unit type:

Studio apartments are typically 300 to 500 square feet.

One-bedroom apartments are 600 to 800 square feet.

Two-bedroom apartments are 900 to 1,200 square feet.

Three-bedroom apartments are 1,200 to 1,700 square feet.

Cost Per Unit to Build an Apartment Complex

The cost to build an apartment complex in the U.S. varies widely. On average, it ranges from $4,700,000 and goes up to $52,000,000. This estimates building a single unit in an apartment complex at $80,000 to $280,000 per unit.

Again, these figures vary depending on your location, type of property, number of units in the apartment, square footage per unit, multifamily construction costs, and many other factors. While the national average can guide you while creating your budget, the costs may differ depending on the above factors.

Apartment Building Cost Calculator

Enter the cost per square foot, number of units, and the average unit size in square feet:

Apartment Building Cost by Number of Units

Generally, the more units you decide to build, the better the pricing is on a per unit basis. That being said, once you get into the 50 to 100 unit plus range, this is where you should start to see the price per door come down.

Just to give you some context, I recently got a bid to build an additional 24 garden style units on a 69 unit property we already own, and it came in around $120k/unit. Keep in mind that I already own the land, and the property is located in Middle Georgia.

Conversely, we also own a Class A, 2008 vintage, 240 unit, mid-rise apartment complex in the the Meyerland submarket of Houston, TX. The cost to rebuild that particular product, in that part of Houston would cost about $279,000 per unit.

As you can see, there is a $150k/unit delta ($270k/unit – $120k/unit =$150k/unit) between the two different types of apartment complexes in two vastly different markets. Further showcasing the variablititly in the cost to build.

With that being said, the following are the average total costs to build a 4 unit, all the way up to a 200 unit apartment building:

| Number of Units | Average Total Cost |

| 4 Units | $500K to $1.8M |

| 10 Units | $1M to $3.5M |

| 20 Units | $2M to $7M |

| 50 Units | $5M to $18M |

| 100 Units | $10M to $35M |

| 150 Units | $15M to $53M |

| 200 Units | $20M to $70M |

A Pre-COVID vs. Post-COVID World for Apartment Developers

Like every other sector, the pandemic affected the construction industry and development scene. The cost of construction rose due to several factors. Since more people were at home, there was a rise in interest in DIY and home-based construction projects.

With high demand and low supply, the cost of lumber and other building materials surged. That, combined with a construction workforce shortage, caused further pricing pressure, to name a few variables.

Some of the factors include:

- Labor shortages and hourly wages continue to rise

- Supply chain disruptions

- Unprecedented money printing from 2020-2021, as a result driving a high inflationary market

- The war in Ukraine and the U.S. sanctions imposed on goods coming from Russia

In the competitive landscape of today’s job market, companies are vying for a finite pool of skilled workers, resulting in an upward pressure on wages. The sustained demand for skilled construction labor, combined with a shortage of qualified candidates, exacerbates the situation. Contributing factors include an aging workforce and waning interest in trade careers among younger generations.

The price of construction rose by 17.5% from the beginning of COVID to 2021. Many building materials are affected by volatile prices.

These materials include glass, concrete, and steel products. Steel prices rose by more than 120% in 2021 alone. Softwood lumber rose in cost by more than 85% as the U.S. imposed a double tariff on Canadian lumber and wildfire disrupted lumber production.

This trend is expected to change the preference for building materials and the types of apartments investors are constructing. However, the housing market has been predicted to stay strong in 2024. With the housing shortage, apartment construction could increase to help close the housing shortage gap. It may also delay some projects as rising rates continue to squeeze developers as their burn rate on borrowed funds increases.

With all this in mind, investors and construction professionals may want to secure material purchases and prices for their upcoming projects before prices can soar again.

Related Read: Should I Invest in Real Estate Now?

New Regulations on the HVAC Industry

Come January 1, 2025, the HVAC industry will face fresh regulations from the Environmental Protection Agency aimed at curbing greenhouse gas emissions stemming from coolants. While the full extent of these implications remains to be seen, one thing’s for sure: the industry is bracing for impact.

The Key People Needed to Build an Apartment Community

A typical construction project has many moving parts, which all need different professionals to work in harmony. While the project may initially start with the developer and main investors, eventually, many professionals join the team since such projects require a lot of hands to come to fruition.

Here is a breakdown of the key people needed to build an apartment community:

- Architect: As an investor, you need to hire an architect during the initial stages of the project. This is the professional to who you express your dream and idea. The architect then draws and designs plans to guide the contractors during construction. While their main job is to arrange every detail in the building, they can also help you come up with the initial budget.

- General Contractor: Once the drawings and plans are complete, the investor will appoint a general contractor. Their main job is to ensure the project is licensed and acquire all necessary permits. They’ll then hire subcontractors and generally oversee the construction of the apartment building. It’s crucial that the investor carefully chooses the general contractor since the role highly influences the project’s direction.

- Subcontractors: Subcontractors are the professionals who handle the actual construction. They handle excavation, steelwork, carpentry, electrical work, painting, plumbing, and flooring. The subcontractors are hired by the general contractor, meaning they sign the contracts with the general contractor.

- Real Estate Attorney: No apartment construction project should start without a real estate attorney on the team. An attorney will help your team with the legal building and construction laws. They’ll help you understand the zoning regulations in your locations and draft different contracts for the contractors. Ensure your attorney is experienced in real estate and understands your area’s laws.

Of course, this list wouldn’t be complete without mentioning an investor. If you’re not financing the project, you can consider getting a mortgage from a traditional lender.

Also, view alternative funding sources such as private lenders and debt funds. These alternative financing options can be more flexible compared to conventional lenders.

The Phases of Construction for a Ground-Up Apartment Development

Like any other construction, an apartment complex development has to go through different phases. The stages are:

- Phase 1 – Planning and Pre-Construction: Many people fail to realize pre-construction is one of the longest stages of apartment development. The planning stage takes a long time since you must determine the project’s feasibility in terms of budget, time, and scope. Such projects need a lot of money, and even private development firms need some time to raise the required funds. Once planning is complete, the pre-construction stage commences. This is where the architect comes up with the plans and designs. The general contractors also start submitting bids to the project owner, and eventually, one is picked.

- Phase 2 – Construction: This stage includes everything from groundbreaking to the finishing touches. This is where the sub-contractors build the foundation and walls, roof the property and install all utilities. They also establish the fixtures, paint every unit, and floor the apartment. During the phase, the general contractor must see that every subcontractor delivers on schedule.

- Phase 3 – Lease Up & Sell: This stage could also be referred to as the refinance & hold phase, depending on the investor’s strategy. The subcontractors clean up the site, clear the debris and submit the final pay requests. The general contractor will assign the subcontractors if there are any remaining issues. The final inspections happen, and the investors then leases, sells, or refinances the apartment complex based on their strategy.

The Average Timeline to get an Apartment Occupancy Ready

A 2020 report by the Census Bureau shows that 75% of apartment complex building projects with 20 units or more take more than 13 months from the groundbreaking to being ready for occupancy.

On average, this could take anywhere between 12 to 24 months.

However, keep in mind that every project is different. Some delays caused by the weather, payment issues, and material shortages could cause the project to take much longer than expected.

How Much Money is Required to Build a Complex?

Many variables influence the total cost of building apartment complexes. These variables include the cost of labor, materials, architect, attorney, general contractor, subcontractors, and many others. Also, as we mentioned earlier, building costs vary depending on location, building style, and material type.

For example, high-rise apartment buildings typically require more materials, so you can expect to spend more. Also, the more luxurious the apartment is, the more you’ll spend.

To get a general idea of the cost required to build a complex, here’s a breakdown of the project items and the average cost percentage:

Project Item | Average Cost Percentage |

Architect | 8-10% of the total cost |

Structural Engineer | $5,000-$20,000 |

General Contractor | 25% of the total cost |

Foundation | 9% |

Wood walls | 6-10% |

Masonry walls | 9-10% |

Floor structure | 12% |

Plumbing | 12% |

Windows and doors | 5% |

Roof | 10% |

Electrical | 10% |

Flooring | 5% |

Interior finish | 10% |

Interior features | 3-5% |

Kitchens | 8% |

Affordable Housing vs Luxury Apartments

Before commencing your apartment complex construction project, you need to decide whether you’re developing affordable housing, luxury apartments, or both. The apartment construction costs for both styles are not far off, but that depends greatly on the apartment amenities you decide to build out and the particular finishes of each unit. However, keep in mind that affordable housing has lower rent.

Most U.S. cities have zoning policies that dictate that you have to build some affordable housing when developing market-rate apartments. Local authorities have different policies governing how many of your units in your apartment complex need to be affordable and how much rent you can collect per square foot.

These policies force affordable housing upon developers in most instances, meaning your market rate rent has to compensate for restricted rent.

However, the monthly rent you collect doesn’t justify affordable housing costs. Due to these, the government has come up with some incentives to compensate for the restrictions. You can benefit from cheap loans, tax breaks, and density bonuses regarding affordable housing.

Be sure to do your due diligence. Affordable housing may not make financial sense in your situation or location due to the housing shortage. Research area zoning laws and calculate your overhead expenses when comparing affordable housing and luxury apartments.

Good Read: How to Build a Real Estate Portfolio

Frequently Asked Questions About The Cost to Build an Apartment Complex

An apartment’s profitability is based on its location, the number of units it has, the land acquisition costs, and the hard and soft costs of constructing the complex from the ground up. That being said, profit is variable depending on those mentioned above.

According to the Census Bureau, you can expect to spend from $4,700,000 to $52,000,000. Again, this figure depends on the location and number of units you want to develop in your apartment complex.

Cost to Build a Multifamily Apartment Community - Conclusion

The cost of building an apartment complex depends on many variables, such as location, cost of building materials, and the number of units.

The national cost per square foot average is $310. This figure can go up or down depending on the named variables. Make sure you work with a real estate attorney in your team to comply with the local zoning regulations and avoid any legal issues in the future.

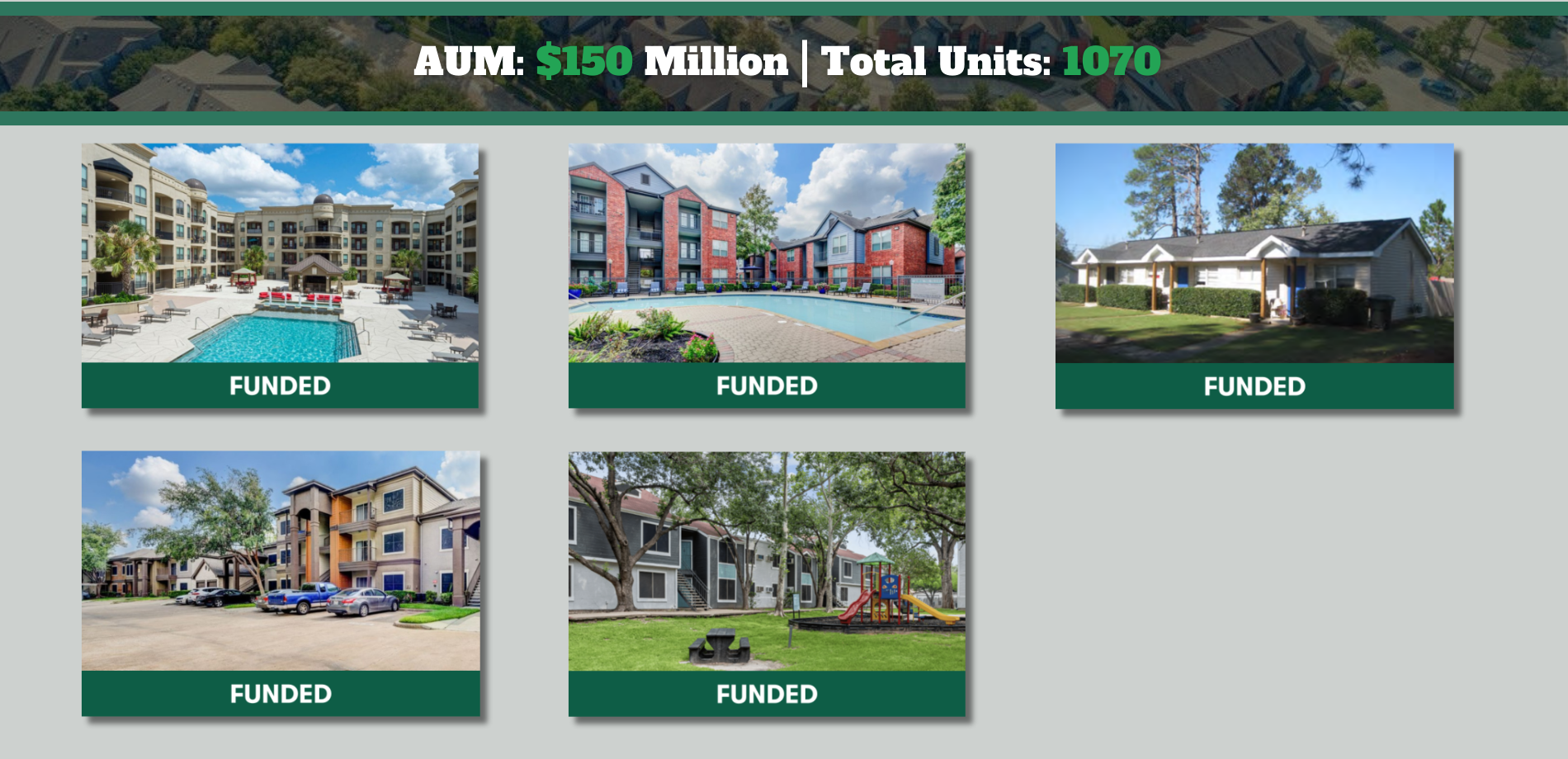

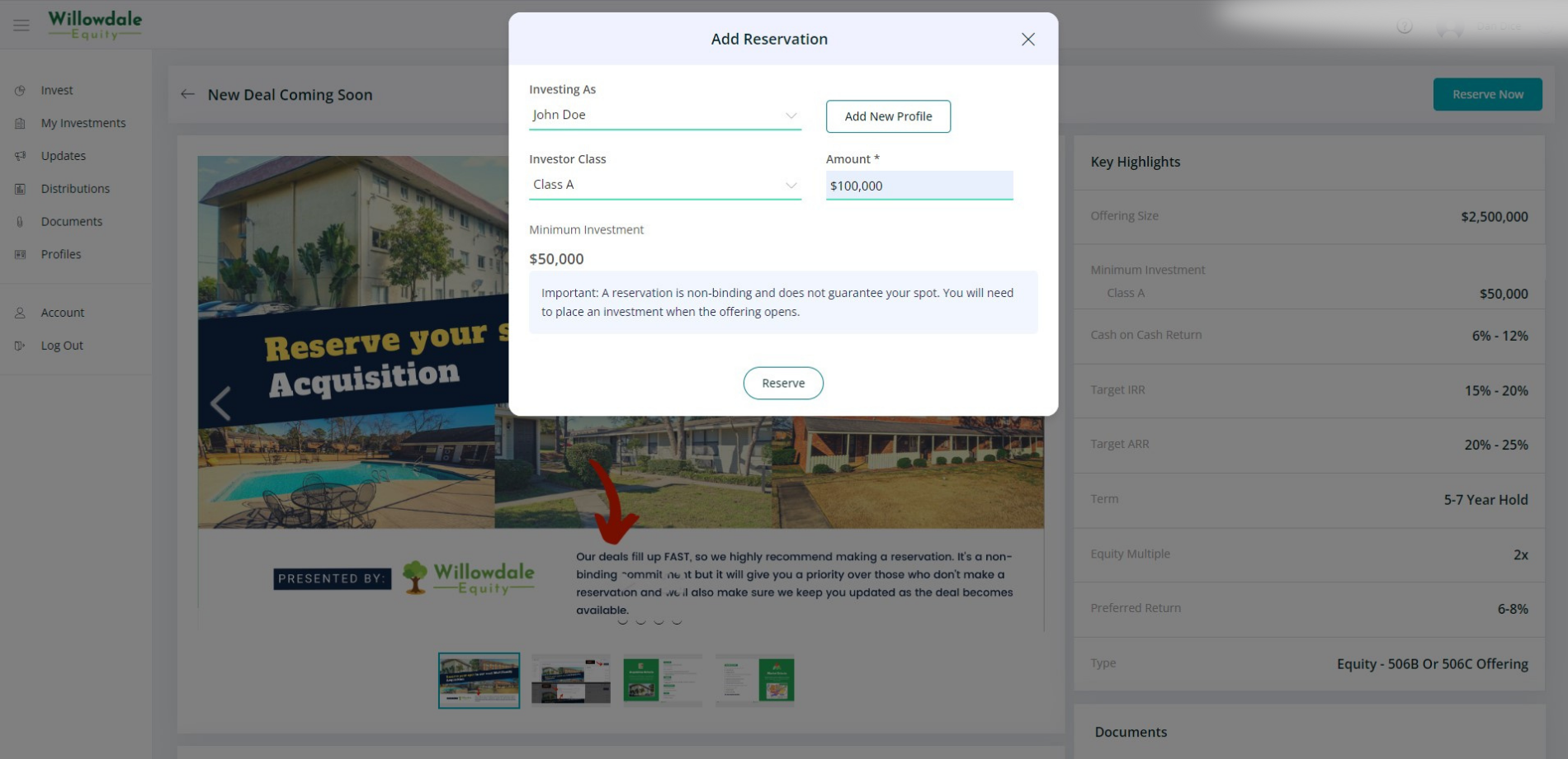

If you’re looking to invest in already built value-add multifamily properties well below their replacement cost across the southeastern United States, join the Willowdale Equity investor club today.

Sources:

The Willowdale Equity Investment Club is a private group of investors that are looking to passively grow their capital and share in all the tax benefits through multifamily real estate investments.