Multifamily Real Estate As A First Investment

This article is part of our passive investors guide on real estate syndications, available here.

The multifamily investing asset class has many more sources of income-producing items, especially when compared to single-family.

Multifamily real estate can be very exciting and profitable if you go about it correctly. Although the goal in multifamily investing is to create a ton of value and execute operations while being prepared to play the long game, it’s essential to understand your exit strategies before even closing on the property. As with any other type of commercial real estate investing or rental real estate, there are specific challenges you should expect and plan for to have the best outcome.

When you acquire a significant multifamily real estate investment, you need to understand your ceiling and limitations for the property, what’s driving the local economy, and the area’s demographic profile. These fundamentals are crucial for analyzing the building’s potential with a long horizon.

As multifamily investors, we are trying to peer into the future as much as possible and make the best assumptions based on the data and trends. Without a deep understanding of these fundamentals, you’ll have many blind spots in your projections, thus lacking all the tools you need to succeed in this business.

Key Takeaways

-

The National Apartment Association predicted that the United States would need to build 328,000 new apartment units each year to accommodate yearly renter growth. Only on average, 239,000 units have been produced each year over the last ten years.

-

It’s way easier to get a residential property manager to manage 100 tenants on one site as you would in a 100-unit multifamily apartment community, compared to 100 individual tenants in 100 different homes scattered across a city, for example.

-

Multifamily ownership is less power-dependent, economically more sustainable, and not susceptible to the swings in management quality that one sees in the single-family market.

-

There are many ways to invest in multifamily real estate passively. Two of the most common methods are through a REIT or a Real Estate Syndication. Both investment vehicle allows the passive investor to take advantage of leverage. Still, only a Real Estate Syndication gives the passive investor all the tax advantages of owning commercial real estate.

Investing in multifamily real estate

The relationship between economic forces and demographic trends is complex. Multifamily real estate tends to lag negative economic change because people require homes more than commercial shopping malls or corporate office buildings. On the other hand, the multifamily asset class is more resilient through market fluctuations and has less volatile asset values.

Compared to other asset classes, especially other types of commercial real estate, COVID-19 has shown that multifamily is well-protected. Empirically, multifamily has shown less volatility than any commercial real estate asset class over the last several decades. In terms of risk-adjusted return, multifamily has historically provided the most significant rate of return.

The erosion of retail has been gradually worsening as a result of the disruption brought about by e-commerce giants like Amazon, as well as the pandemic closures. Universities were closed, and courses had to be moved entirely online, creating difficulties for student housing.

Many organizations made the shift to remote working as a result of the office closures. Senior living homes also became a fertile ground for COVID-19. Throughout all that, multifamily properties showed encouraging trends, with more robust collections in all areas, as housing is a fundamental human need.

% of Apartment Households Earning Greater Than $75,000/Year

According to The National Multifamily Housing Council, there has been a substantial rise in higher-income payers. The chart on the right shows the percentage of renters who make $75,000 per year. From 1990 through 2010, this group of renters made up 18% of the overall renter population, but by 2020 they will account for more than 25%. A higher-earning demographic of tenants will continue to drive accelerated rent increases in the long run.

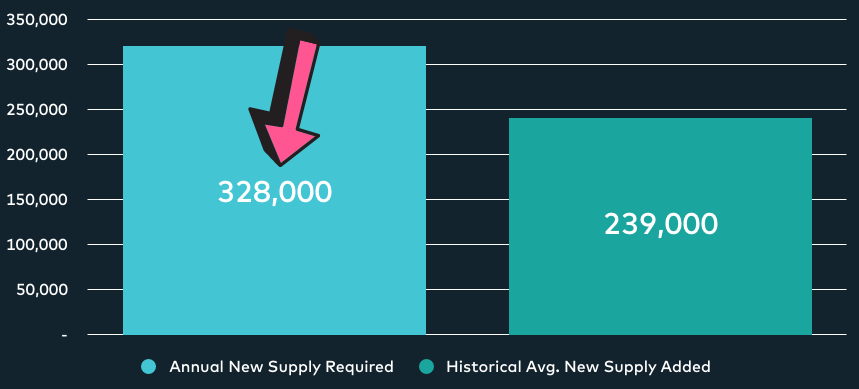

Annual New Supply Required to Keep up with Forecasted Demand Growth

The National Apartment Association predicted that the United States would need to build 328,000 new apartment units each year to accommodate yearly renter growth. Only on average, 239,000 units have been produced each year over the last ten years. The supply deficit is restricted by increasing building expenses, which merely enable a multifamily developer to construct an A-Class product (A more premium style, greater rent apartment) with a more robust return profile.

The problem is that the type of housing with significant supply constraints is affordable housing rather than more expensive apartments. As a result, this is keeping vacancies low and demand high.

Baby Boomers & Millennials Want To Rent!

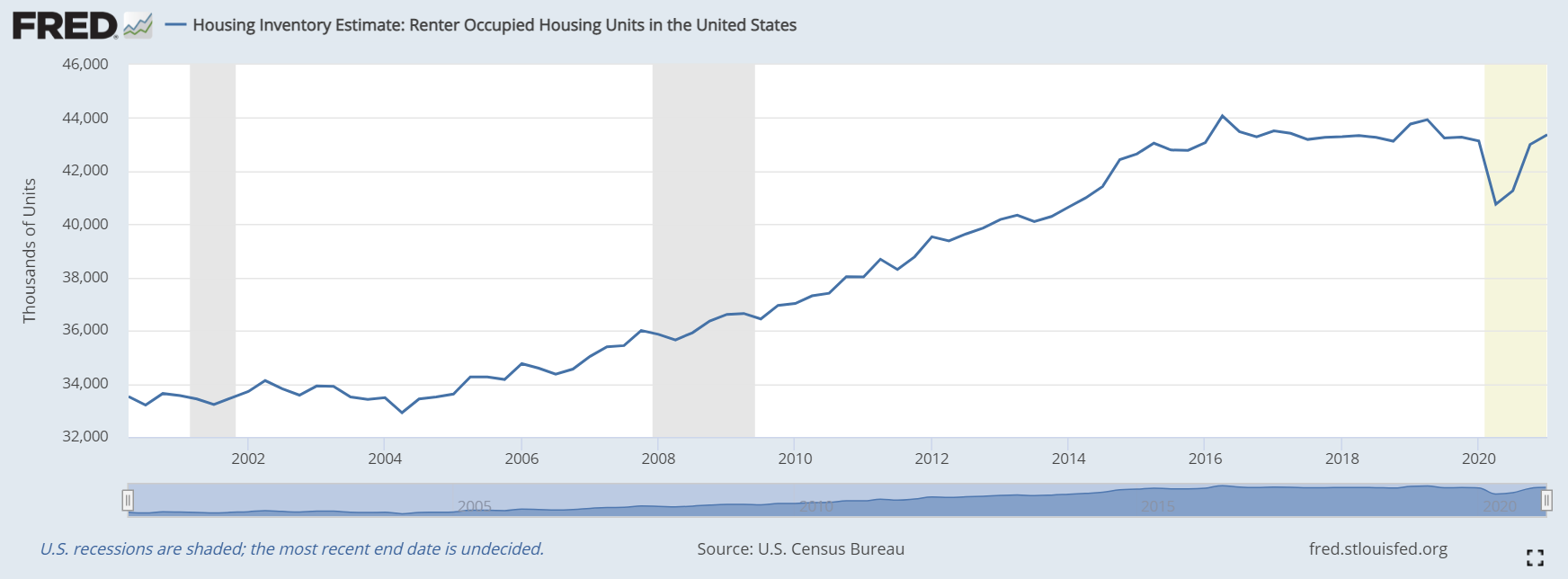

Millennials and Gen Z are the largest renter segment, accounting for more than 39 million individuals aged 18-34. According to the US Census Bureau, there are over 100 million renters in the United States, which is a record high and will rise yearly. But another demographic will continue to drive a significant amount of the growth and fundamental demand for multifamily housing in the near future. According to the National Apartment Association, half of the increase will come from net new migration to the United States.

At this moment, 35% of Americans born citizens are renters. Immigrants also prefer renting in comparison to purchasing, suggesting future solid demand. Additionally, 70% of recent immigrants who came to the United States over the past ten years have chosen to rent, indicating a bright future for the sector.

Managing the Property

Scalability is very hard to achieve as finding a quality property management company requires a higher percentage of the monthly income to manage the property for you, which hurts your cash flow. In comparison to multifamily, property management companies charge a lower monthly rate on a per-unit basis.

It’s way easier to get a residential property manager to manage 100 tenants on one site as you would in a 100-unit multifamily apartment community, compared to 100 individual tenants in 100 different homes scattered across a city, for example.

Why multifamily is the best investment?

Multifamily ownership is less power-dependent, economically more sustainable, and not susceptible to the swings in management quality that one sees in the single-family market.

Owners of multi-unit buildings are usually lower on primary economic indicators like debt load or valuation; they need neither rely on a mortgage lender nor be content with any stock brokerage’s transient appraisal opinion. They own what they owe. This high degree of elasticity helps minimize volatility for owners.

A simple way to feel it out is by looking at something like this example (using Houston, TX, as an example). In 57% of Houston metro areas, over 50K population density homes sell for 20% below market value during their first year on the market, while apartments take 9%.

Multifamily real estate investing can be a great investment decision for many reasons:

- Tax Advantages: The tax deductions and tax advantages that come with it, which include being able to write off operational expense items and taking advantage of “paper losses” through various forms of depreciation that tax shelter net income.

- Cash Flow: The positive cash flow that the property produces every month, which exceeds your monthly debt service that’s going towards the principal paydown of outstanding debt.

- Market Appreciation: You have the opportunity to build equity through value appreciation resulting from buying in the right market.

- Forced Appreciation: The opportunity to force appreciation and value through making physical or operational improvements to the property to provide more value to tenants. This allows you to earn more and move the building’s valuation (Net Operating Income/ Market CAP=Value).

- Lower Vacancies: Multifamily properties tend to have lower vacancy rates than single-family homes, meaning that you are likely to have tenants paying rent every month, which contributes to a steadier income stream. Finally, multifamily properties offer opportunities for economies of scale. By owning multiple units in one complex, you can save on advertising, management fees, and repairs since they will be spread out among all the units.

Develop An Exit Strategy For Your Multifamily Property

Develop a plan that considers whether improvement, replacement, or selling will be your best option and at which point you should consider a refinance. Additionally, at what point should you consider selling the property?

Having a clear exit strategy significantly changes the risk profile of any deal. Executing your value-add business plan within that first 18-24 month period will create a large amount of equity that can be tapped into through a successful refinance if the goal is not to sell. This value-add business plan can be achieved through interior or exterior improvements, upgrading or adding community amenities, optimizing expenses, and increasing operating efficiencies.

Understanding Market Drivers

Economic forces and demographic trends are interrelated. Multifamily real estate demand mirrors demographic trends such as where people live, family size, and the demographic makeup of populations within a given market or neighborhood. But since residential dwellings are the most indispensable function of the built environment, multifamily real estate properties tend to lag the economic fluctuations.

In other words, people need places to live more than shopping malls or office buildings. As such, the multifamily asset class tends to be more resilient through market cycles and exhibits fewer swings in asset values.

Diversified Tenancy

Office properties, industrial buildings, and retail properties usually have only one or a small handful of tenants locked into long-term leases. On the other hand, multifamily real estate rental properties can have tens or even hundreds of diversely structured rental agreements with tenants turning over on a rolling basis.

This arrangement provides downside protection by minimizing vacancy exposure during economic downturns. Put differently, there’s an ever-present risk of 100% vacancy with a single-family home, whereby the property may produce no rental income for months as you seek a new tenant.

The same can happen with single-tenant commercial properties. A multifamily real estate property with several tenants will exhibit some degree of vacancy. But a vigilant operator can typically keep vacancies to less than 10% of the property’s units allowing the property to continue to operate in the green.

Accredited vs Non-Accredited Investor

It’s essential to understand whether or not you would satisfy the requirements to be classified as an uncredited investor.

The SEC defines an accredited investor as someone with a yearly income of $200,000 or more (or $300,000 for married couples filing jointly). An individual can be an accredited investor if they have a net worth over $1 million, excluding the value of their primary residence.

How do I invest in a multi family apartment?

There are many ways to invest in multifamily real estate passively. Two of the most common methods are through a REIT or a Real Estate Syndication. Both investment vehicle allows the passive investor to take advantage of leverage. Still, only a Real Estate Syndication gives the passive investor all the tax advantages of owning commercial real estate.

Check out our Frequently Asked Questions (FAQ) page to get the answers to all the questions you might have.

Frequently Asked Questions About Investing In Multifamily Real Estate

The amount of capital needed to invest in a multifamily property varies depending on many factors, such as what market it’s located in, the number of units, the in-place rents, the property’s age, and much more. Investors can access passive multifamily real estate investment opportunities for as low as $50,000 in most real estate syndications.

Multifamily properties appreciate a very steady rate year over. Since the beginning of the COVID-19 pandemic, we have seen multifamily as an asset class appreciate at a high rate compared to historical appreciation. This is mainly due to a low-interest-rate environment, cap rate compression, and high inflation due to large-scale money printing.

Should I Invest in Multifamily Properties

Read up and educate yourself as much as possible to have a good foundation in understanding how it all works in multifamily real estate investing. Once you’ve done that, you can have a more informed conversation with whomever you partner with. Suppose you invest with an operator like us here at Willowdale Equity.

In that case, we take care of all the underwriting and analysis, projections, construction, operations, and much more, allowing individual private real estate investors to grow their investment portfolios and invest alongside us. To learn more about how it works, you can watch the video on our Investor Club page.

Sources:

Interested In Learning More About PASSIVE Real Estate Investing In Multifamily Properties?

Get Access to the FREE 5 Day PASSIVE Real Estate Investing Crash Course.

In this video crash course, you’ll learn everything you need to know from A to Z

about passive investing in multifamily real estate.

We’ll cover topics like earned income vs passive income, the tax advantages, why multifamily, inflation, how syndications work, and much much more!