Real Estate Syndication Tax Benefits For Passive Investors

This article is part of our passive investors guide on real estate syndications, available here.

Whatever income bracket you fall under, regardless of whether your income source is from your W-2 or your business, the goal is to earn more and find more ways to shelter those earnings. That’s where an investment vehicle where investors can pool their funds and resources together to purchase larger assets can be of great value.

This investment vehicle, referred to as a real estate syndication, can help give investors true passivity in their investment with all the same property tax advantages of being a full-time operator.

In this article, we’ll break down the core real estate syndication tax benefits and how income in a syndication is taxed.

Key Takeaways

-

Tax-advantaged investing should be a top priority in this day in age as the cost of living continues to rise, the silent tax of inflation continues to be a factor, and as taxes rates increase in some parts of the U.S.

-

Real estate syndication income is taxed as passive income, as generally, the IRS considers all rental real estate activity to be passive.

-

Taking advantage of the depreciation on a commercial real estate asset that you share as a passive investor in a real estate syndication is one of the most significant reasons investors invest.

Benefits of Syndication

Syndications offer many benefits to passive investors, allowing them to share in all the great things that private real estate investing offers. These deals are put together and offered to you, the investor, taking months of underwriting and passing on deals to find that needle in a haystack. In fact, most sponsors will go through deep underwriting on hundreds of deals until they find the one.

This allows investors to save all the time, energy, negotiations, cost, and expertise and invest in an investment-ready opportunity. Once you make your capital contribution to the deal, you can effectively avoid all the not-so-sexy parts of real estate, primarily managing the day-to-day operations. This means not dealing with disgruntled tenants in the wee hours of the morning or dealing with and scheduling various contractors and vendors.

Leverage is the best way to explain what a syndication does; it allows the passive investor to leverage all the resources and capital involved in this pool to take part in all the great things about commercial real estate in a completely passive role.

How is Syndication Income Taxed?

Real estate syndication income is taxed as passive income, as generally, the IRS considers all rental real estate activity to be passive. It’s important to note that you can use your passive losses from rental real estate to offset your other passive income. It’s difficult, but if you can prove “material participation” in the real estate you own, you would qualify for “real estate professional tax status” allowing you to use these passive losses against your active income. It’s best to contact a tax professional to find out if you qualify and how this tax status would affect your taxable income.

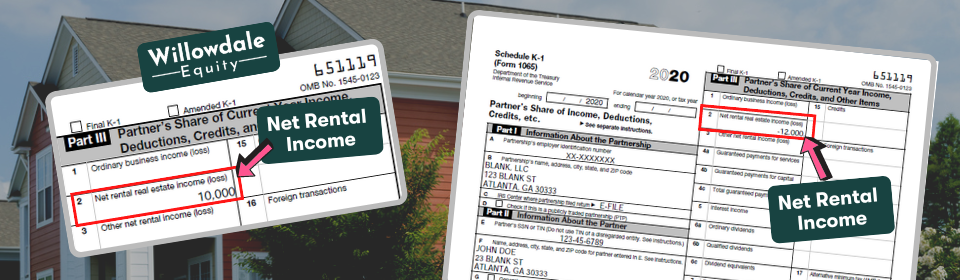

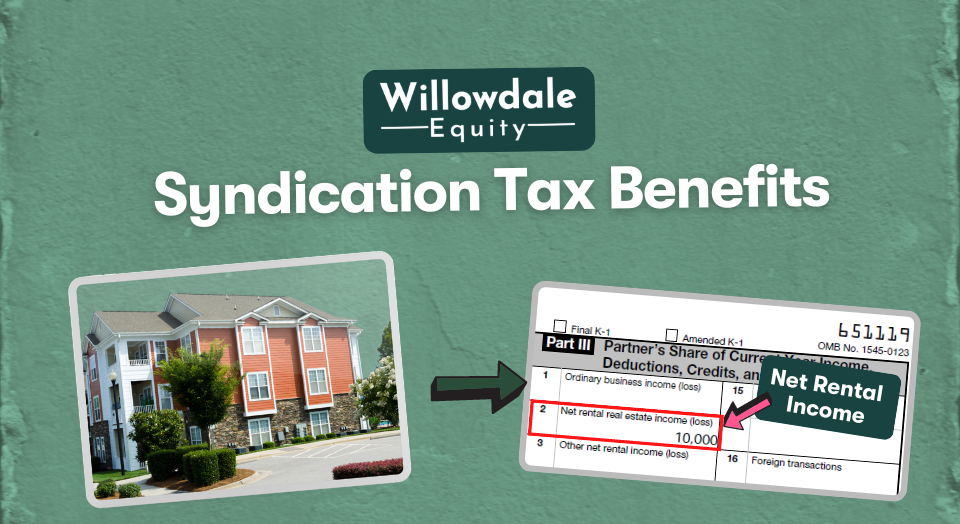

You’ll receive your schedule K-1, which is your pro rata share of the income, losses, deductions, and credits from the syndication. If your K-1 says you made money, you will pay the marginal income tax rate on that amount. But if the number on your K-1 reads a negative number which often happens due to the power of things like depreciation (which we’ll explain more in detail below), then you won’t owe anything.

Let’s now look into some of the lucrative tax benefits a real estate syndication provides investors.

Real Estate Syndication Tax Benefits

Tax-advantaged investing should be a top priority in this day in age as the cost of living continues to rise, the silent tax of inflation continues to be a factor, and as taxes rates increase in some parts of the U.S. The focus should be to find ways to keep more of what you earn, so you can invest more to outpace all the factors trying to erode your purchasing abilities. This is unique to syndication, unlike other forms of real estate investing like REITs.

The following are the core ways in which a real estate syndication provides significant tax benefits for passive investors:

- Depreciation

- Carrying Over Passive Losses

- Cash-Out Refinance

- Lower Capital Gains Tax Rate

- Mortgage Interest

- 1031 Exchange

Depreciation

Taking advantage of the depreciation on a commercial real estate asset that you share as a passive investor in a real estate syndication is one of the most significant reasons investors invest.

The IRS is mindful that a property physically deteriorates due to wear and tear. The IRS allows you to depreciate the building (NOT the land) over 27.5 years for a multifamily property. This is “straight-line depreciation”, as the building value would be divided over 27.5 years, and you could use this as a “paper loss” over that period every year when it comes to tax time.

Additionally, there is a way to accelerate those losses by having a 3rd party engineer perform a cost segregation to grab what’s referred to as “accelerated depreciation” or “bonus depreciation”. The cost segregation study is to break down all the items in the building and around the property and allocate them to 5, 7, and 15-year depreciation schedules. All these items that fall under the 5, 7, and 15-year schedules can be expensed up to 60% in the first year as of 2024 (this will drop by 20% until year over year until it phases out in Jan 1st 2027).

For quick math to get an idea of what I’m talking about in example form, you may be able to write off 15-25% of the purchase price in that first year of ownership. So on a $10,000,000 deal, that means as much as $2,000,000 in “paper losses”. Meaning if you invested $100,000, you could leverage $100,000 in “paper losses” in that first year.

Many high-earning professionals love commercial real estate and syndication simply for the power of depreciation, where in some cases, but not in all, they may qualify for “real estate professional tax status”. This would enable select investors that are eligible to leverage their passive losses from the syndication against their active income from their W-2.

Carrying Over Passive Losses

Leveraging the large “paper losses” from bonus depreciation in year 1 of the syndication will lead to losses in far excess of the cash flow that was generated in that first year. This means that not all those “paper losses” can be utilized to shelter the cash flow, so all the losses that weren’t able to be used will carry over to the following year.

These losses can continue to be carried over, and in some syndications, investors will not pay taxes on the distributions for the duration of the 5-7 year hold period of the syndication, as they have far more losses than the cash flow they’ll ever receive.

Let’s say you invested $100,000 as a passive investor, and for every $100,000 invested, there’s $80,000 of depreciation paper losses that an investor can share in. If you earned $5,000 in cash flow distribution in year 1, you would have a -$75,000 ($5,000- $80,000) on your K-1 tax form. Since you have an excess of losses in the amount of-$75,000, this amount will carry forward to year 2.

Related Read: Do Stocks Outperform Real Estate?

Cash-Out Refinance

The cash-out refinance effectively allows passive investors in a real estate syndication to have a large liquidity event tax-free. A refinance involves getting a new loan on the property and using the new loan with new terms to repay the old loan.

The cash-out refinance occurs when there is a surplus of loan proceeds after paying off the old loan. This cash surplus would be distributed evenly to passive investors based on the interest they own in the syndication.

A good example would be if the original loan were $5,000,000, and now the new value of the apartment community was $10,000,000, and the syndicator goes and secures a 70% LTV loan or $7,000,000. The $7,000,000 would first pay off the $5,000,000 existing loan balance, and the excess $2,000,000 ($7,000,000-$5,000,000) would be distributed to investors. Therefore, the $2,000,000 the investors receive is a loan, and there are no income taxes owed on these funds as a loan is not considered a gain; it’s a debt.

Lower Capital Gains Tax Rate

Capital gains are the profits generated from the sale of the property and are subject to taxation, which is referred to as “capital gains taxes”. The rule is that if the property is held for less than 12 months, the gains would be considered short-term capital gains and taxed at the ordinary income rate, which can be as high as 37%.

Since the property would likely be held for more the 12 months in a syndication, the gains would be classified as long-term capital gains, which can be as high as 20%. Making a syndication an advantageous vehicle to be tax-efficient when maximizing the gains at the exit of a deal.

Mortgage Interest

The interest paid on a mortgage annually can be used as a deduction item. That means whatever the total interest paid on the mortgage at the end of the year will be used to shelter the syndications income further.

1031 Exchange

The 1031 exchange is one of real estate investors’ most powerful strategies to defer their capital gain liability. This is done by utilizing section 1031 of the U.S. Internal Revenue Code, which allows you to sell your real estate investment property and exchange the gains from the sale for a “like-kind” property within 180 days of the sale. Now there are way more details to how the 1031 exchange needs to be structured, so you should contact a qualified 1031 intermediary, but it’s important to note how it fits into real estate syndications.

Generally, this can get rather complicated but if all the partners in a syndication agreed to 1031 out of the investment together once the property is sold, this can be done. As you can imagine, it’s challenging to have investors all in alignment to defer their profits, so this is not as common of a strategy, but it can indeed be done.

Frequently Asked Questions About Tax Benefits of Real Estate Syndication

Yes, you can invest in a syndication with an LLC. Investors might use their LLC to fund their real estate investments for various reasons, such as tax benefits and having a layer of asset protection.

Yes, you can 1031 into a real estate syndication, but it is not as common as there is an added cost to take on 1031 funds from investors and added headaches. The most common way of structuring this is through what’s referred to as a TIC (Tenancy-In-Common), where the 1031 investor is not a general or limited partner but an individual owner who owns a direct interest in the property through this TIC.

Real Estate Syndication Tax Benefits - Conclusion

Leveraging all the great tax benefits that a real estate syndication offers allows you to focus more on your core competencies and tasks that move that needle in your life. Enabling you to keep more of your hard-earned dollars and invest more to repeat and compound that cycle.

If you’re looking to access private multifamily syndication investment opportunities across the southeastern United States, apply to join the investors club here at Willowdale Equity today.

Sources:

The Willowdale Equity Investment Club is a private group of investors that are looking to passively grow their capital and share in all the tax benefits through multifamily real estate investments.