What is T3 in Real Estate? & What is T12 in Real Estate?

This article is part of our guide on passive investing in multifamily via syndication, available here.

How does one verify, audit, and analyze a cash-flowing producing commercial real estate asset? One of the necessary items needed in that process is the financials which is also referred to as a financial statement, income statements, cash flow statements or a P & L. Being able to digest all the line items in a real estate financial statement will help you understand what’s happening under the hood financially and to get an idea of how they arrive at their current net operating income.

In this article, we’ll breakdown down what is T-3 in real estate and what is T-12 in real estate.

Key Takeaways

-

A T-3 in real estate is an abbreviation for the “trailing 3-month” financial statements for a particular property.

-

A T-12 in real estate investing refers to the “trailing 12-month” financials of a real estate property.

-

When investors refer to a T-12 for a real estate investment, there essentially asking to see a profit and loss statement of all the property’s income and expenses for a set period.

What is T3 in Real Estate?

A T-3 in real estate is an abbreviation for the “trailing 3-month” financial statements for a particular property. These financial statements will look back at all the income and expenses at the property over the last three months. Investors like this look at a T-3 to see more current numbers for the property.

Investors will also give more weight to the earnings of the trailing three months as rents generally rise yearly. Next, we’ll showcase an example of what a T-3 looks like.

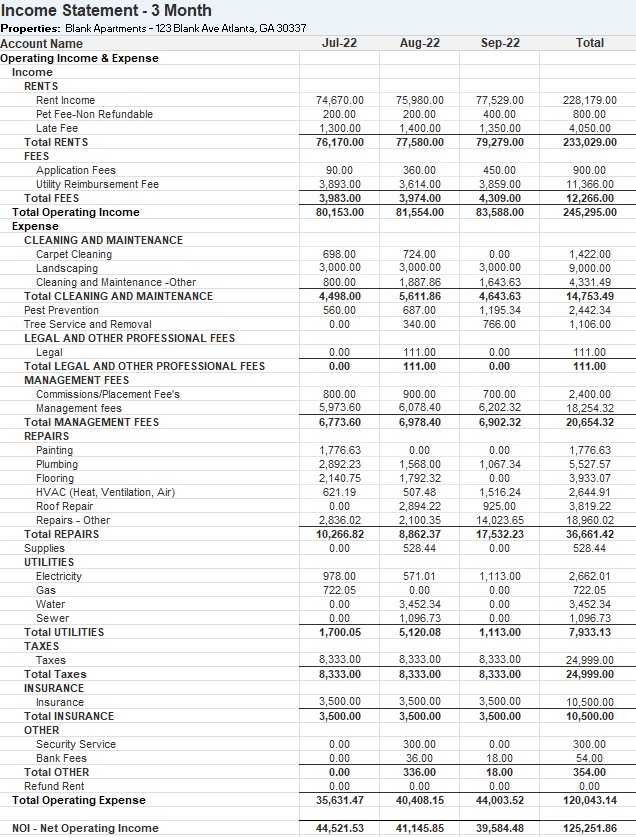

T3 Example

Below is an example of real estate T-3 for an apartment complex.

What is a T12 in Real Estate?

A T-12 in real estate investing refers to the “trailing 12-month” financials of a real estate property. This is reflected in a financial statement showcasing the previous 12 months’ income and expenses at a particular property.

The T-12 is the most common financial statement real estate investors, and prospective lenders will ask to review before acquiring or recapitalizing a property. Next, we’ll break down an example of a T-12.

Good Read: What does LOI Stand for?

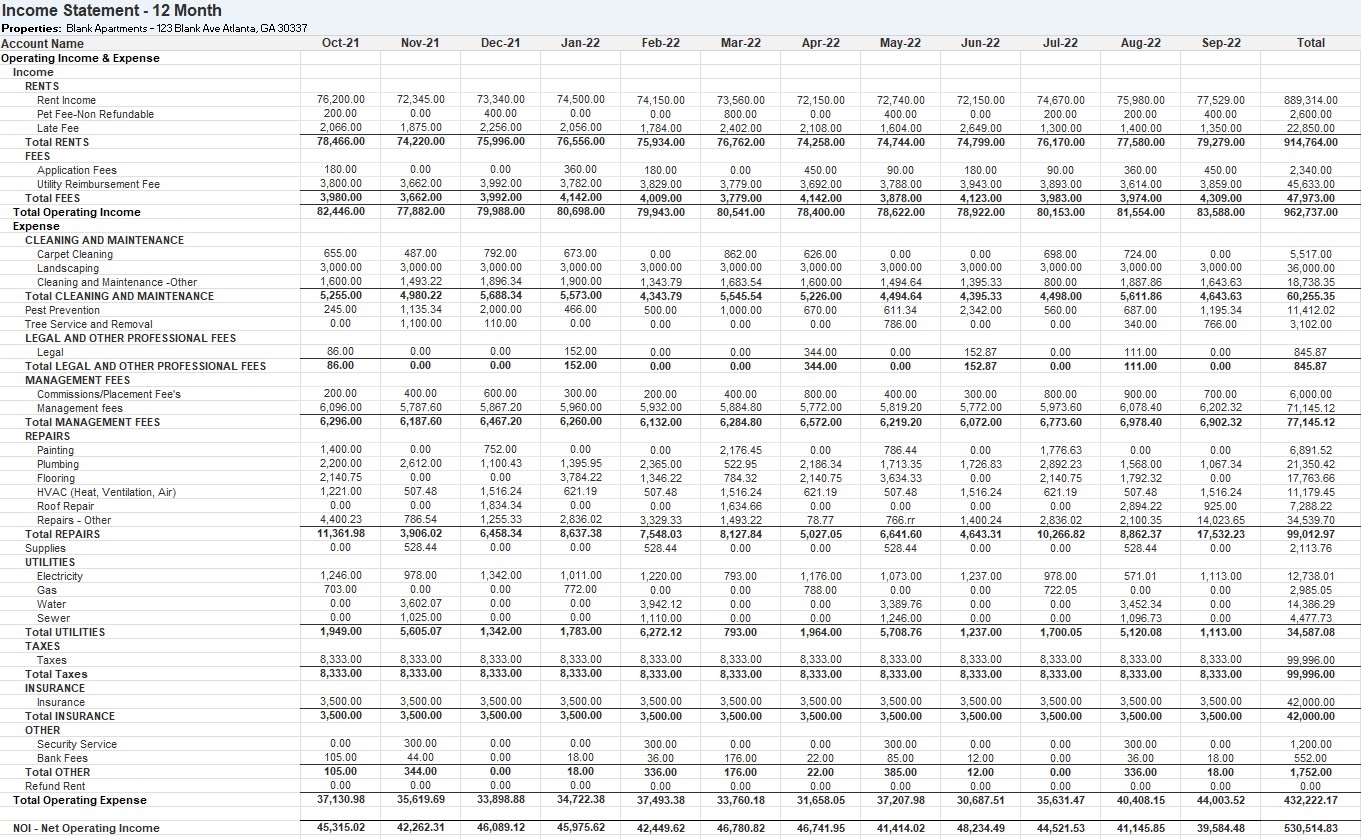

T12 Example

Below is an example of real estate T-12 for an apartment complex.

The Difference Between T12 and P&L

A T-12 and a P&L which is short for a “profit and loss statement,” is the same thing. When investors refer to a T-12 for a real estate investment, there essentially asking to see a profit and loss statement of all the property’s income and expenses for a set period. The T-12 refers to the set period of the trailing 12 months.

Good Read: How is Occupancy Calculated in Real Estate?

Why the T3 and T12 are so Important

The T3 and T12 financials are crucial for real estate investors. The following are some of the ways these reports are essential:

- Showcasing the asset’s current and past performance: These financial statements will broadcast all the operating income and operating expenses to see how the property has performed to better understand what kind of debt it can support and its current market value. Processing this financial data will help you understand and make more informed decisions.

- Showcase where the property is trending: With the present and past numbers taken into account, a real estate investor can use this to make an educated forward-looking projection for the property’s financial performance.

- Showcase where improvements can be made: By diving into each line item, you can identify things that can be improved. Things such as certain expense items that you can reduce by getting better vendors or maybe by charging back utilities to tenants to offset the expenses to you, the landlord, for example.

- How the T-3 and T-12 are used in tandem: Some investors use the T-3 and T-12 in tandem when analyzing a real estate investment opportunity’s current value by using the T-3’s income figures and the T-12’s expenses figures to underwrite its current value.

Frequently Asked Questions About What is a T-3 in Real Estate

A T12 includes all the income and expenses figures related to the subject real estate investment over the last 12 months of operation.

There are several interchangeable names for a T12 report, the most common would be a “TTM”.

T12 expenses are the expense listed on a trailing 12-month financial statement. In a real estate T-12, you might see expense items such as real estate taxes, insurance, utilities, payroll and repairs, and maintenance, to name a few.

T-3 & T-12 in Real Estate Investing - Conclusion

The trailing 3 months and 12 months of a real estate investment give an investor an almost complete snapshot of the property’s performance without having an updated rent roll. It also helps investors identify expenses that can be offset, lowered, consolidated or even other income items that can be improved after a close financial analysis.

If you’re interested in learning more about other real estate investing concepts and terms like the T-3 and T-12, join our FREE 5-Day Passive Real Estate Investing Video Crash Course.

Interested In Learning More About PASSIVE Real Estate Investing In Multifamily Properties?

Get Access to the FREE 5 Day PASSIVE Real Estate Investing Crash Course.

In this video crash course, you’ll learn everything you need to know from A to Z

about passive investing in multifamily real estate.

We’ll cover topics like earned income vs passive income, the tax advantages, why multifamily, inflation, how syndications work, and much much more!