What is Asset Management in Real Estate?: Multifamily Real Estate Asset Manager Responsibilities

This article is part of our guide on property management and asset management, available here.

Most people mistake asset management for property management, an entirely different but connected management function.

Simply put, a property manager handles daily/routine operations, such as maintenance, rent collection, and filling vacant units in a multifamily property.

In contrast, real estate asset managers are tasked with handling every aspect of property acquisition, ensuring performance, and executing the business plan and dispositions on behalf of its real estate investors.

To further clarify the confusion, we’ll dive deeper into some of the responsibilities of a multifamily real estate asset manager.

Key Takeaways

-

It involves tracking and monitoring commercial and residential properties’ financial value to ensure the asset performs according to its projections.

-

The first and most important goal of an asset manager is to maximize the value of their firm’s investment portfolios. They focus on making a property as attractive as possible for tenants and the next buyer.

-

Savvy asset managers collaborate with property managers to ensure steady cash flows, improve budgeting for maintenance, and make the necessary capital improvements for as long as they plan to hold a property.

What is Asset Management in Real Estate?

Real estate asset management is accumulating, protecting, and maintaining wealth over time by acquiring, maintaining, and trading real estate properties. It involves tracking and monitoring commercial and residential properties’ financial value to ensure the asset performs according to its projections.

What does a Real Estate Asset Manager Do? - Real Estate Asset Manager Responsibilities

A real estate asset manager specializes in handling several aspects of managing an investment property, including:

- Managing cash flows

- Evaluating property valuation based on market research and developing strategies for value retention and future acquisitions/dispositions.

- Predicting revenue and market performance based on long-term financial projections, etc.

What a Real Estate Fund Manager & Real Estate Asset Managers Fundamental Goals Are

Real estate fund and asset managers are responsible for high-level decision-making for their assets on behalf of their investors.

Unlike property managers, who are responsible for managing cash flow, tenants, and upkeep, asset managers have three fundamental goals:

1.) Maximize Property Market Value

The first and most important goal of an asset manager is to maximize the value of their firm’s investment portfolios. They focus on making a property as attractive as possible for tenants and the next buyer. They do this by ensuring the property maintains a high occupancy and collections rates and has lean expenses to ensure the highest possible NOI.

Depending on the type of asset, their strategy might include forward-looking at the profile of the next buyer. The asset manager might do this to understand if they need to leave a bit of meat on the bone for the next buyer to add value and achieve a strong return for their investors. This sometimes is a better strategy as sellers can sometimes sell at a lower cap rate due to the next buyer having more upside.

2.) Maximize Return on Real Estate Investments

An asset manager helps improve financial performance for one simple goal – to maximize revenue or ROI. Savvy asset managers collaborate with property managers to ensure steady cash flows, improve budgeting for maintenance, and make the necessary capital improvements for as long as they plan to hold a property.

3.) Minimize risk

Finally, the third fundamental goal of asset managers is to improve risk management and help real estate investors retain asset value. Minimizing risk is essential to managing an investment property and portfolio management.

It typically involves maintaining healthy landlord-tenant relationships, proactively taking care of repairs, creating excellent processes, and conducting market research to predict valuation, among other things.

Creating a Real Estate Asset Management Plan

An asset management plan helps property management services and managers organize, streamline, and centralize all their processes and properties to minimize risk and maximize yields. Creating an asset management plan typically involves the following steps:

Step 1 - Identification

The first step is to create a physical inventory of real estate assets and record all information associated with one, including property values, location, number of tenants (if any), etc. This will improve tracking and reporting.

Step 2 - Evaluation

Next, asset managers must evaluate each property’s current condition to determine its budgeting, maintenance, and other needs.

Step 3 - Execution

Following the evaluation, managers can proceed to address immediate and future needs to preserve and improve their net operating income and value.

Real Estate Asset Management Strategies

Managing any type of real estate investment requires a strategy from acquisition to disposition. The following are valuable strategies to increase revenue, reduce operational costs, and maximize property value:

Developing a Capital Improvement Plan

One great way to improve your property’s value is to learn what other property owners in the same area or neighborhood are offering. Using this research, managers can make educated decisions to bring their property to market. This might include re-branding the complex, adding or improving the amenity package, improving landscaping and curb appeal, improving communal areas, and updating the interiors of available units.

The multifamily rental property market is incredibly diverse and saturated. Therefore, people have a variety of options to choose from. Capital improvements can ensure tenants opt for their properties.

Improving Retention

Unfortunately, tenant turnover is part of the game and often unavoidable, even when owners and managers ensure they provide the best living experience for tenants. As a result, one smart way to maintain steady cash flow is to look for ways to prevent vacancies, such as offering timely response and repair to tenant work orders or improving security.

Establishing Strategic Relationships

Finally, another effective strategy to maximize revenue and value is to reduce expenses by partnering with the most cost-effective vendors, technicians, and maintenance services. Offering preferred status to different providers can also help score discounts and additional value.

Frequently Asked Questions about Asset Management in Real Estate

Asset management is the practice of using targeted measures to improve property management, generate positive cash flow, and increase the value of residential and commercial properties.

A portfolio manager working for a property management company drives investment strategy by conducting financial analysis and making high-level decisions for property owners.

What is Real Estate Asset Management? — Conclusion

Real estate asset management is a fundamental management function that protects real estate investments and helps investors maximize their property value. Asset managers work to enhance risk management and take care of day-to-day operations using their vast market knowledge and cash flow management skills.

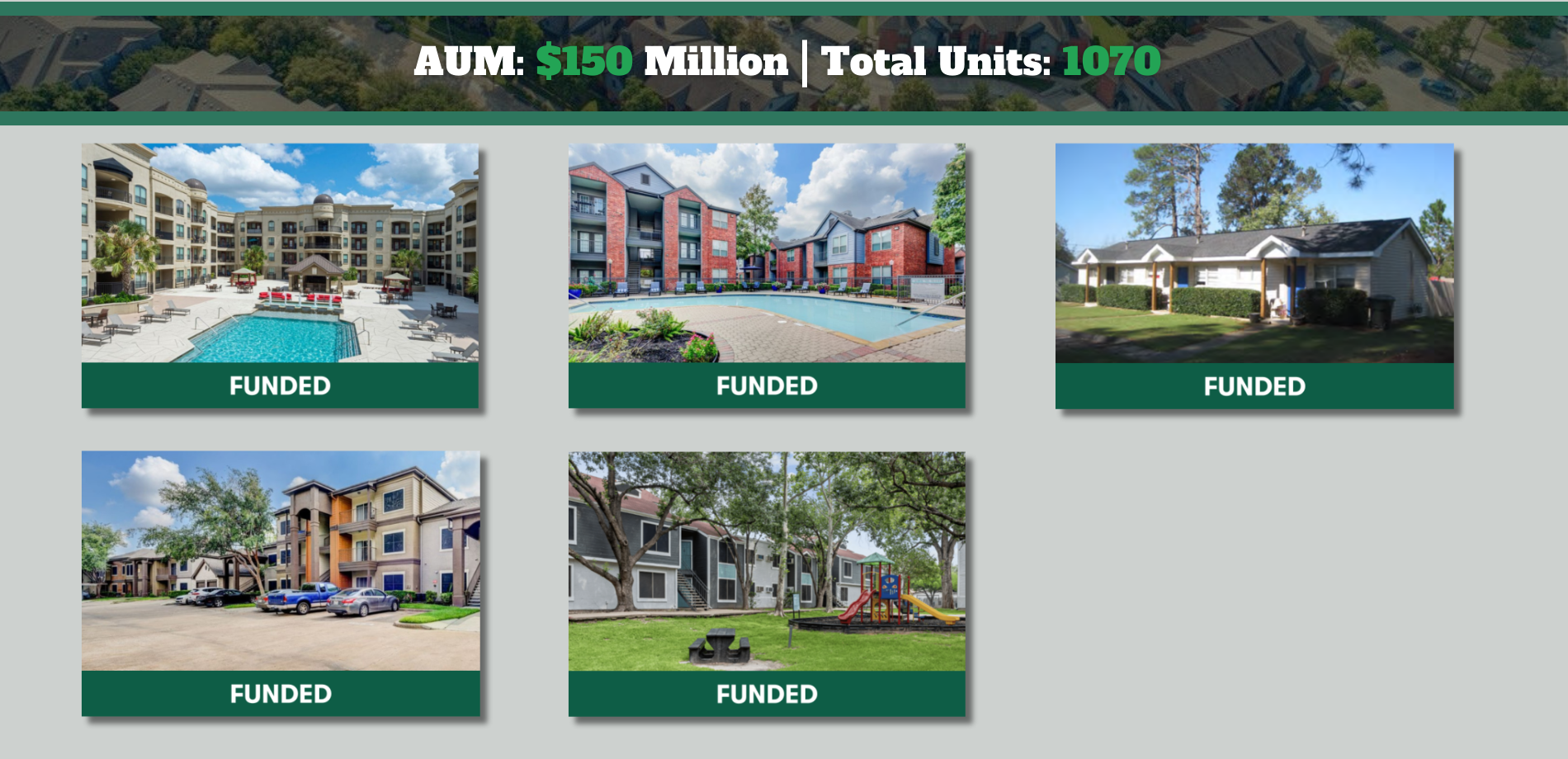

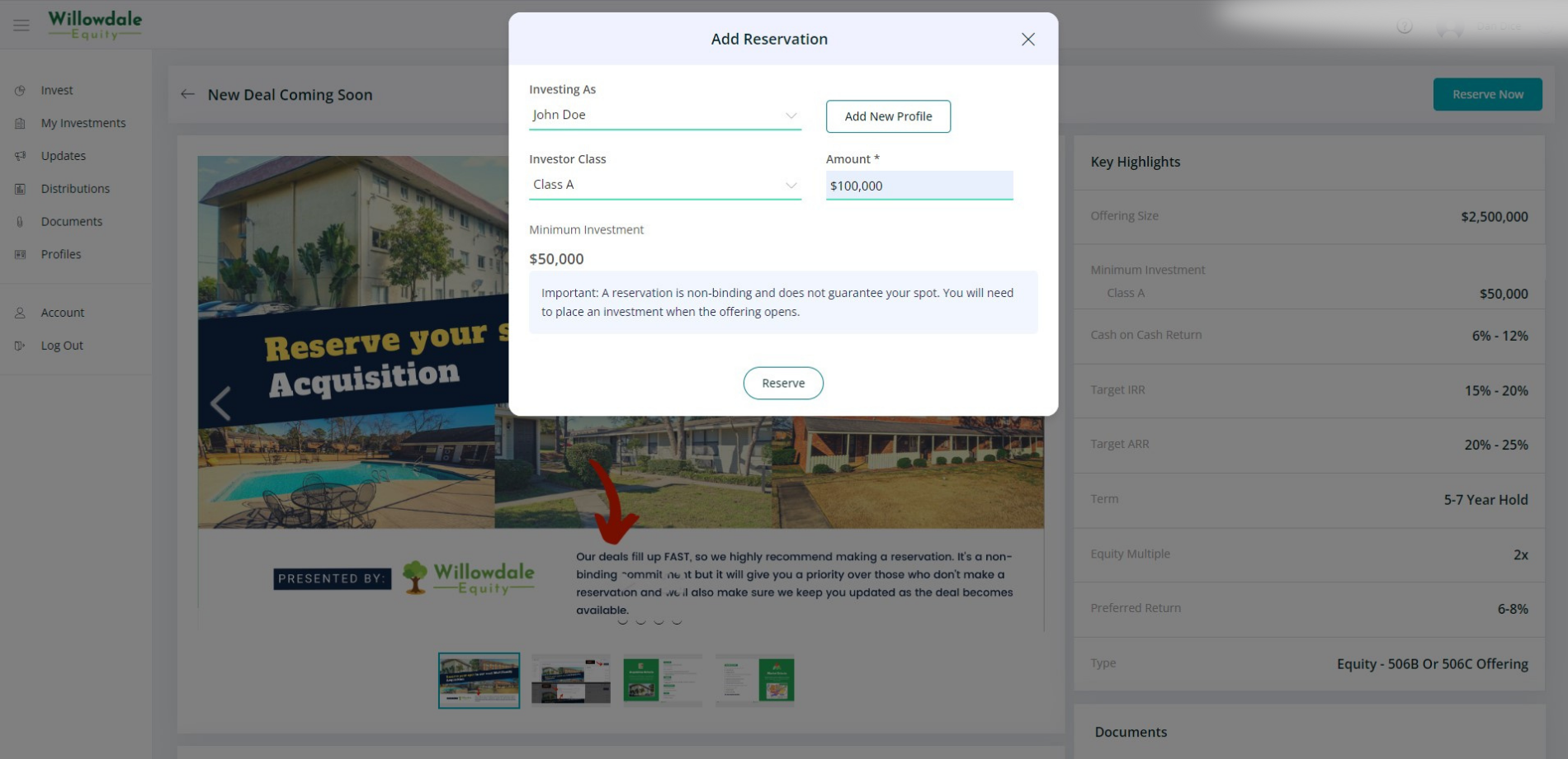

If you’re not interested in managing a multifamily property, join the investors club here at Willowdale Equity to passively invest in value-add multifamily real estate investments across the southeastern United States.

The Willowdale Equity Investment Club is a private group of investors that are looking to passively grow their capital and share in all the tax benefits through multifamily real estate investments.